Private Credit Boom: Career Opportunities in the Fastest-Growing Finance Sector

The private credit market has been growing rapidly and is now a major engine in global finance. Industry research from the Alternative Credit Council (ACC) and Houlihan Lokey estimates global private credit reached US$3.5 trillion in AUM by end-2024, up 17% from end-2023. India is also emerging as a standout growth market, with EY reporting US$9.0 billion in private credit investments in H1 2025, up 53% year-over-year.

Key Takeaways

-

- Learn private credit deal terms and mechanics, including first lien vs second lien, unitranche, covenants, OID, and downside protection

- Pick one entry track and apply to it consistently, choosing from investing/deal teams, underwriting or credit research, fund operations, or investor relations

- Run a targeted networking cadence each week by messaging analysts and associates, asking for feedback on your memo, and requesting referrals when your work is strong

- Apply before completing certifications and use credentials only as an add-on signal, treating CFA Level I or FRM Part I as supportive rather than required

- Choose one niche to start and stay focused for your first set of applications, typically direct lending first, then expand later to real estate debt, distressed, or venture debt

This boom can translate into more openings, faster responsibility, and attractive pay, especially for candidates with strong credit skills (cash-flow modeling, downside thinking, covenant logic) and clear deal communication. At the senior end, many of the world's largest alternative managers run sizable private credit platforms, keeping hiring demand active across investing and platform teams.

Understand the Private Credit Market Explosion

Private credit is when a non-bank lends to companies that can't access or don't want traditional bank debt. It typically includes several major categories:

-

- Direct lending to mid-market businesses: first-lien, second-lien, and mezzanine loans.

- Real estate debt includes bridge loans, permanent financing, and construction financing.

- Lending arrangements backed by assets and cash flow are examples of structured finance.

- Infrastructure debt: funding for projects related to energy, transportation, utilities, and digital infrastructure

- Distressed debt and special circumstances: acquisition of distressed assets, restructuring, and turnaround financing

Why is it exploding?

This boom is driven by three lasting forces that will keep propelling private credit for years ahead:

1. Banks are pulling back: Post-2008 regulations require banks to hold more capital and charge higher fees, making them less willing to lend—especially to mid-market companies earning $25M–$500M in EBITDA. These businesses are now turning to private direct lenders who can move faster and structure deals more flexibly.

2. Private equity is sitting on record dry powder: With $1.6 trillion in uninvested capital, PE firms are aggressively expanding their credit platforms. Private credit allows them to deploy capital more quickly than equity strategies, which typically require 5–7-year holding periods.

3. Institutional investors need higher yields: Pension funds, insurance companies, and family offices are allocating more to private credit because it offers 10–15%+ returns, far above the 3–5% yields available in public bond markets.

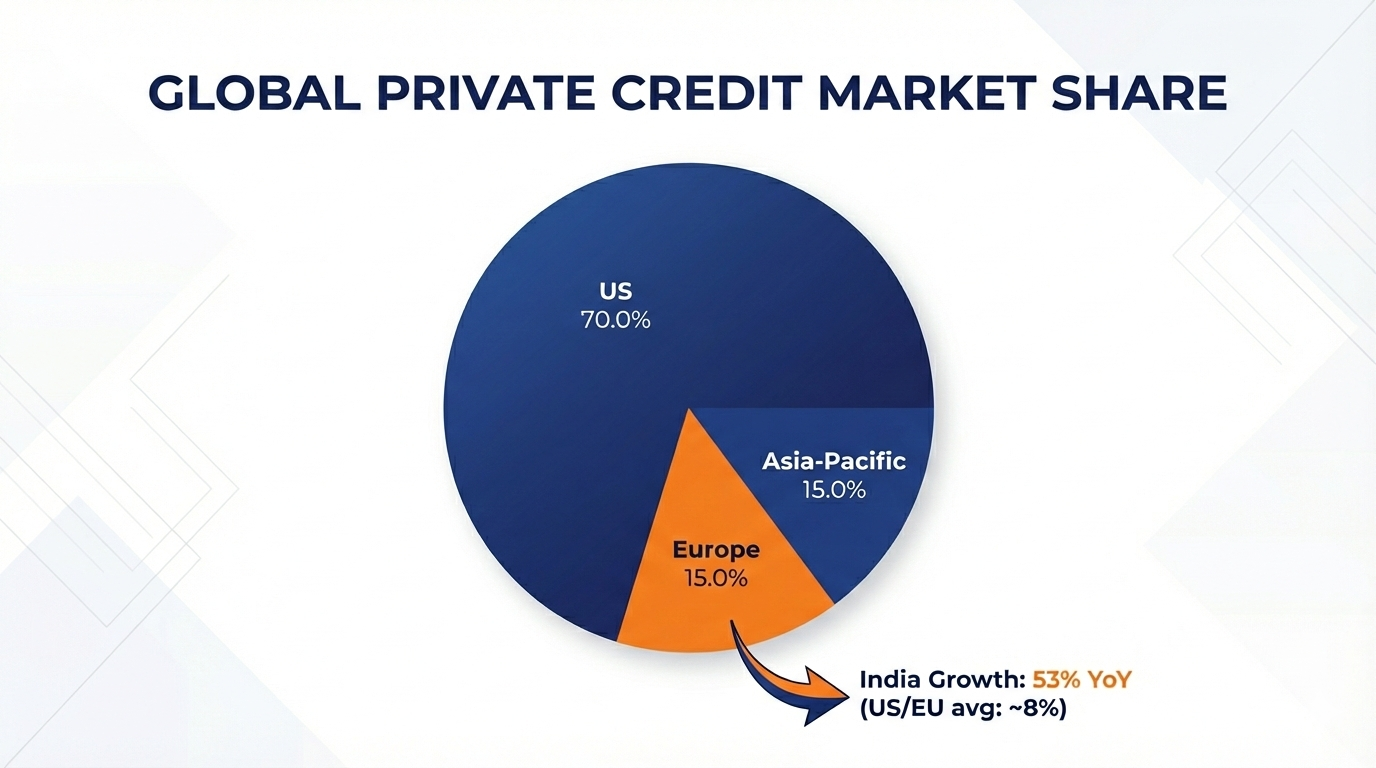

The US has historically accounted for about 70%+ of the private credit market, but the growth story is shifting toward Asia-Pacific, especially India, where reported growth has been as high as 53% year-over-year, giving early entrants a first-mover advantage with faster responsibility and earlier exposure than in more mature markets.

Private credit acts as a bridge between banks and private equity: when banks pull back and equity can feel too dilutive, private lenders can structure flexible capital solutions that help companies raise the funding they need while targeting attractive returns for investors.

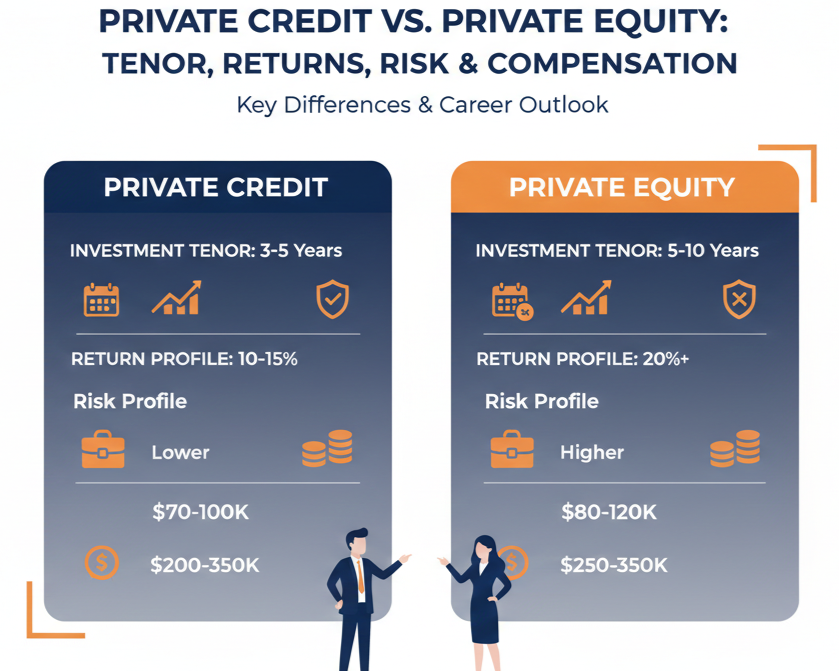

Comparing Private Credit and Private Equity: Tenor, Returns, Risk, and Compensation

Therefore, private equity requires fewer investment years, lower risk, and faster promotions, making it a better option than traditional PE for professionals seeking rapid career growth.

Identify the Core Role Types Across Private Credit Firms

In private credit companies, the teams are divided into four core functional pillars, each of which has its own unique role, responsibilities and pay scales:

| Functional Pillar | Role | Responsibilities | India Salary (LPA) | US Salary (All-in) |

|---|---|---|---|---|

| 1. Investment Professionals (Deal Makers) | Credit / Debt Analyst (0–2 yrs) | Source deals, screen opportunities, build financial models, assess credit risk, and prepare investment committee materials | ₹12–16 (₹14–18 with CFA) | $70K–$100K |

| Senior Credit Analyst (2–4 yrs) | Lead deal analysis, conduct due diligence, present to IC, mentor junior analysts | ₹20–28 | $120K–$160K | |

| Credit Investment Manager / Associate (4–6 yrs) | Source deals, structure complex financings, negotiate, drive origination pipeline | ₹28–40 | $150K–$220K | |

| Vice President (6–8 yrs) | Lead origination, manage client relationships, sign off on deals, mentor team | ₹50–75 | Origination strategy, leadership, negotiation, portfolio oversight | |

| 2. Credit Research & Underwriting | Credit Research Analyst | Analyze industries, assess credit quality, evaluate macro impacts, prepare research memos | ₹15–22 | $90K–$130K |

| Senior Credit Officer | Approve structures, determine pricing, set covenant packages, and make final credit decisions | ₹35–50 | $180K–$280K | |

| 3. Fund Operations (Plumbing) | Operations Associate / Fund Accountant | Manage cash movements, calculate NAV, prepare monthly/quarterly reporting, track portfolio data | ₹12–16 | $70K–$100K |

| Senior Operations / Reporting Manager | Oversee operational functions, manage auditors/custodians, ensure compliance and reporting accuracy | ₹25–35 | $120K–$160K | |

| 4. Investor Relations & Capital Raising | IR Associate | Prepare marketing materials, coordinate meetings, manage data rooms, track LP commitments | ₹14–18 | $80K–$110K |

| Vice President, Investor Relations | Lead fundraising, present to LPs, negotiate terms, and shape capital-raising strategy | ₹45–65 | $200K–$300K |

Knowing these core role types makes it easier to see how private credit teams operate and how careers progress. Each pillar, from deal sourcing and underwriting to fund operations and LP relationships, helps protect capital and drive performance, while offering structured growth, strong pay, and deep specialization in a fast-growing part of global finance.

How Operations Experience Translates Into Investing Careers

Operations roles in private credit may sit away from the investing spotlight, but they keep the fund running and give unmatched visibility into how deals actually work. By handling NAV calculations, portfolio accounting, cash movements, compliance, and reporting, operations teams build a strong understanding of deal mechanics, portfolio performance, and how investor capital flows through the fund.

That exposure often makes operations a practical launchpad into investing. High-performing operators who develop strong analytical skills and show real deal curiosity can move into junior investing or credit analyst roles in about two to three years, because they already understand fund structures, documentation, covenants, and the key drivers of performance.

Map Entry-Level Positions and Salary Benchmarks

India Private Credit Analyst Entry (0–2 years)

In India, one of the most popular places to start a career in alternative investments is as an entry-level private credit analyst. Analysts are the analytical core of private credit teams and support the entire deal process, from sourcing leads to creating materials for the investment committee.

Compensation

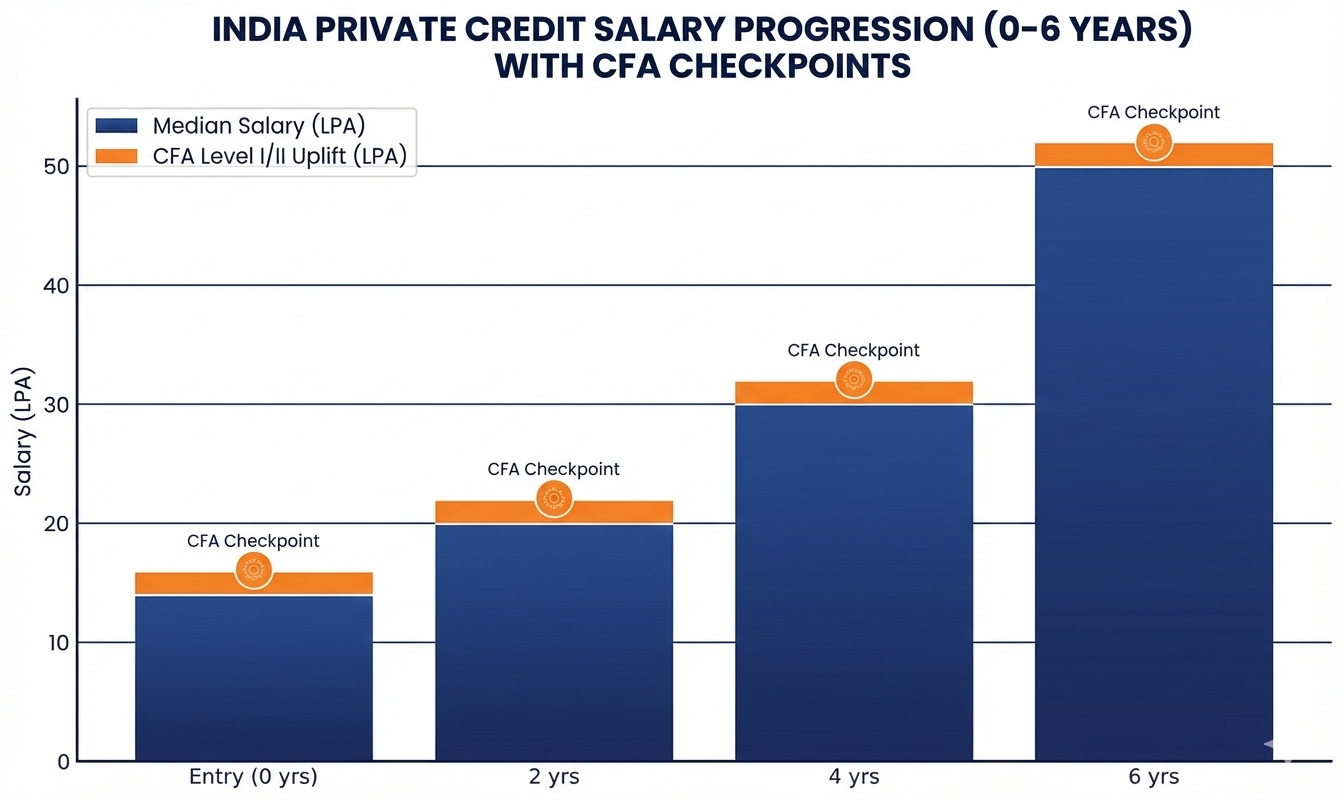

The typical range of entry-level CFA salaries is ₹12–16 LPA, with a median of ₹14 LPA. Because funds value their proven dedication to financial analysis and structured learning, candidates who have passed CFA Level I or II typically receive higher packages in the ₹14–18 LPA range.

Who Employs

The private credit sector in India is experiencing rapid growth, and both domestic and international companies are hiring new analysts. Prominent recruiters include:

-

- Ares, Carlyle, Bain Capital (Credit), Apollo, and KKR are international credit platforms.

- Motilal Oswal PE Credit, IIFL Credit, Edelweiss, Centrum, Avendus, Vivriti, and Northern Arc are examples of domestic credit funds.

The position is competitive, but it has a significant impact because these companies typically hire small, high-performing cohorts of analysts.

Everyday Obligations

In direct lending and structured credit transactions, entry-level analysts are essential. They are usually in charge of:

- Creating initial investment theses and assessing deal sourcing prospects.

- Carrying out thorough financial analysis, which includes sensitivity analysis, cash flow forecasting, and three-statement modeling.

- Evaluating borrower creditworthiness by investigating market dynamics and competitive environments.

- Assisting senior analysts with due diligence procedures related to business, finance, law, and operations.

- Creating presentation decks and materials for investment committees while maintaining precision, clarity, and analytical rigor.

Qualifications for Entry-Level Positions in Private Credit

It usually takes a combination of professional qualities, technical expertise, and academic credentials to break into an entry-level private credit or direct lending analyst position. Among the fundamental expectations are:

- Bachelor's Degree: Candidates generally come from finance, commerce, economics, accounting, or quantitative disciplines. A competitive advantage comes from a solid academic record and coursework in corporate finance, financial modeling, or fixed income.

- Technical Expertise: Excel: Capacity to create and evaluate financial models, analyze cash flow, run sensitivities, and handle big datasets. PowerPoint: Making succinct, understandable presentations for internal discussions, deal teams, and investment committees.

- It is ideal to be familiar with basic credit metrics and financial databases like Capital IQ and Bloomberg.

- Interest in Credit and Private Markets: It is highly appreciated when someone shows an interest in lending, capital structures, credit instruments, and risk assessment. Candidates who comprehend how companies create cash flows and pay off debt stand out.

- Work Ethic and Stamina: Private credit is time-sensitive and deal-driven. Analysts need to be able to multitask across workstreams, manage long hours during live transactions, and maintain high accuracy under pressure.

- Professional Attributes: It is crucial to have strong analytical thinking, meticulous attention to detail, effective communication, and the capacity to work with senior team members.

IB Analyst vs. Private Credit Analyst: Detailed Comparison

Both roles offer strong foundations in finance, but they differ in compensation structure, lifestyle, work exposure, and long-term growth. Here's a comprehensive view:

| Aspect | Investment Banking (IB) Analyst | Private Credit Analyst |

|---|---|---|

| Salary (India) | ₹18–25 LPA (bonus-heavy; bonus 50–120% of base is common) | ₹12–16 LPA (₹14–18 LPA with CFA) |

| Skill Focus | Valuation, comps, pitchbooks | Cash flow modeling, credit underwriting, risk assessment |

| Work Hours | Very long hours (80–100/week) | Long but more stable (60–75/week) |

| Promotion Timeline | 2–3 years → Associate (competitive; MBA often preferred) | 2–3 years → Senior Analyst/Associate (internal promotions common) |

| Exit Opportunities | PE, Corporate Strategy, VC, HF | Direct lending career, PE credit, corporate banking, leveraged finance |

Although entry-level cash compensation for Investment banking analysts is higher, the Private Credit Analyst provides: Quicker promotions, Greater responsibility for analysis, Greater exposure to structuring and credit, more robust long-term trajectory over a period of five to eight years, Access to a quickly growing private market segment.

Private credit is becoming one of the most appealing options for candidates looking to pursue careers in private markets with significant growth potential.

Understand Mid-Career Progression and Compensation

Mid-career trajectories in private credit are now among the most desirable in private markets due to the robust growth of the private credit market. Due to strong private credit fund hiring, growing AUM, and deal-driven promotions, analysts in entry-level credit fund positions frequently progress quickly. The career progression from two to ten years is broken down below, along with duties, pay, and opportunities for advancement.

| Career Stage | Experience | India Compensation | Global Benchmark | Promotion Dynamic | Key Responsibilities |

|---|---|---|---|---|---|

| Associate/Senior Analyst | 2–4 years | ₹20–28 LPA (median ~₹23 LPA) | - | Analysts who meet performance expectations; promoted automatically in 2–3 years | • Lead deal analysis & underwriting • Run major due-diligence workstreams • Present to investment committee • Mentor junior analysts • Own 2–3 deals annually • Build early sponsor/borrower relationships |

| Senior Associate/Investment Manager | 4–6 years | ₹28–40 LPA (median ~₹32 LPA) | - | Top 50% of Associates; consistent deal leaders; strong origination instincts | • Originate/evaluate deals independently • Structure complex financings (unitranche, mezzanine, 2nd lien) • Negotiate with sponsors & management teams • Drive origination targets (₹200–500 crore) • Mentor associates & analysts |

| Vice President (VP) | 6–8 years | ₹50–75 LPA | $250K–$400K+ | High performers reach VP in 5–6 years (faster than IB/PE) | • Lead origination for sector/region • Manage LP relationships • Approve deal structures/pricing • Manage 3–5 team members • Represent firm at conferences • Participate in strategic/IC discussions |

| Senior VP/Managing Director | 8+ years | ₹75–150+ LPA | $400K–$1M+ | High performers reach SVP by year 8–9 due to private credit market growth | • Drive firmwide origination strategy • Manage institutional LP relationships • Oversee portfolio risk/performance • Lead sector strategy & team scaling • Participate in partnership/IC decisions • Significant carry (5–10%+) |

Private credit provides a fast-tracked, performance-based career path where responsibilities and pay increase quickly with experience. One of the most appealing private credit career opportunities in India and around the world, analysts can advance from Associate to Senior VP in 8–9 years, gaining extensive exposure to deal origination, structuring, and LP management while reaping substantial upside through carry and partnership opportunities.

The Private Credit Acceleration Factor: Fast-Tracking Careers Through Performance

The quick, performance-based promotion path is one of the main benefits of private credit career opportunities. Private credit offers ambitious professionals accelerated growth, early leadership exposure, and high-impact experience in direct lending and private credit fund roles. In contrast to investment banking or private equity, advancement in private credit depends on deal execution and results.

1. High Achievers: The Quick Path

Accelerated promotions are given to analysts who regularly produce outstanding results on deals, exhibit sound credit judgment, and make significant contributions to origination and underwriting. This is an example of a high performer's typical progression:

-

- Analyst → Senior Analyst: two years

- Four years as a Senior Analyst → Associate

- Six years as an Associate → Vice President (VP)

- VP to Senior VP: 8 years

High performers can actually advance to VP or Senior VP positions two to three years quicker than their peers in traditional private equity or investment banking, which makes it an attractive value proposition for applicants looking for positions in private credit funds or direct lending in India.

2. Standard Performers: Consistent Advancement

A slightly longer timeline is followed by professionals who perform consistently but do not achieve the same remarkable results:

-

- Three years as an analyst before becoming a senior analyst

- Five years as a Senior Analyst → Associate

- VP → Associate: 7–8 years

- VP → Senior VP: more than ten years

Professionals who want structured growth while still gaining substantial exposure to careers in private markets and the expanding private credit market will find this path appealing.

3. Underachievers: Restricted Progress

Professionals who don't perform up to par may experience lateral movement or a slower career trajectory: Analysts may eventually move laterally into corporate banking, consulting, or other finance roles, or they may stay in the same position for a long time.

This emphasizes how promotions in private credit are driven by deal flow; in contrast to IB, where tenure alone frequently ensures advancement, private credit rewards observable impact and outcomes.

Why Aspiring Private Credit Professionals Should Pay Attention to This

One of the industry's differentiators is the Private Credit Acceleration Factor: Fast-tracked Promotions: Compared to 8–10 years in IB or 10–12+ years in traditional PE, high performers can become VP or Senior VP in 6–8 years. Early Leadership & Deal Ownership: Younger professionals lead deals, oversee teams, and communicate with LPs earlier due to accelerated timelines. Improved Compensation & Carry: You can access profit-sharing and carry earlier if you advance more quickly, which can greatly increase lifetime earnings.

Alignment With Market Growth: High-performers have more chances to grow swiftly and assume significant responsibility in a developing market as hiring for private credit funds increases in India and around the world.

Required Skills and Certifications for a Private Credit Career

It takes a combination of technical know-how, analytical rigor, and soft skills to break into private credit career opportunities. A solid foundation in financial modeling, credit analysis, deal structuring, and relationship management is necessary for candidates hoping to work in direct lending or private credit fund positions in India. This is a comprehensive guide to the abilities, credentials, and resources that will make you stand out.

1. Non-Negotiable Technical Skills

Every applicant for an entry-level position as a credit fund analyst must possess these fundamental abilities, frequently by the Associate level:

Modeling and Analysis of Finances: Create three-statement models in Excel (cash flow, balance sheet, and income statement). LBO modeling: IRR computations and debt repayment plans. Models unique to credit, such as leverage ratios, interest coverage, and debt capacity. Waterfall charts, scenario modeling, and sensitivity analysis.

Due Diligence and Credit Analysis: Evaluate competitive positioning, industry trends, and borrower creditworthiness. Determine the covenant structures (negative covenants, leverage ratios, and EBITDA maintenance). Financials should be tested under negative conditions. Identify early warning signs of poor credit quality.

Pricing and Valuation: Analysis of discounted cash flow (DCF). Comparable business multiples (Price/Sales, EV/EBITDA). MOIC and IRR computations. Coupon rates, discounts, and OID (original issue discount) fees are examples of pricing mechanisms.

Negotiation and Deal Structuring: Recognize the differences between unitranche and conventional first/second-lien structures. Preferred return and mezzanine structures. Financial, operational, and negative covenants make up covenant packages. frameworks for negotiations with borrowers and sponsors.

2. Crucial but Frequently Acquired on the Job

Although not always necessary for admission, proficiency with these tools is becoming more and more important: Python and SQL: Automation, analysis, and data extraction. Bloomberg/FactSet: Pricing, comparables, and market data. Software for fund accounting: SS&C, Black Diamond, and Altus for NAV computations.

3. Essential Soft Skills

A career in direct lending requires more than just technical skills. These soft skills are essential: Relationship Management: Establish credibility with LPs, borrowers, and sponsors. Communication: Effectively negotiate with sponsors and explain complicated credit structures to non-technical LPs. Judgment: Control portfolio risk and make decisions in the face of uncertainty. Resilience: Handle stressful portfolio situations and credit cycles.

4. Certifications: Increasing Pay and Credibility

Although they are not required for admission, certifications can increase your pay as a private debt analyst and hasten promotions.

i) Chartered Financial Analyst, or CFA

Why is it valuable? teaches risk management, ethical frameworks, and portfolio construction. Level I/II entry-level: ₹12–14 LPA → ₹14–18 LPA. Mid-career (4 years): ₹28–32 LPA → ₹32–40 LPA as a charterholder. Timeframe: four to five years to complete the charter (begin Level I in the first job).

It is advised to pursue CFA for long-term private credit or risk-oriented careers; short-term positions prior to PE lateral moves are optional.

ii) Financial Risk Manager, or FRM

Focus: Expert in operational, market, and credit risk. Entry impact: ₹12–14 → ₹14–18 LPA for Part I completion, similar to CFA. Timeline: two parts, six to twelve months. Credit risk analyst or dedicated credit research positions are the best fit.

It is advised to prioritize FRM over CFA when concentrating solely on risk; CFA is favored for more general private credit roles.

iii) MBA

Entry impact: Compared to the ₹12–14 LPA analyst track, a pre-entry MBA may enable direct hiring as a Senior Analyst (₹20–25 LPA). Ideal for: Those looking to accelerate their partner trajectory or those changing careers. Trade-off: Expensive (₹15–30 LPA), but first hires can bypass one or two levels.

| Hierarchy Level | Category | Skills/Tools |

|---|---|---|

| Must-Have | Technical | Excel, Financial Modeling, Credit & Due Diligence, Pricing & Valuation, Deal Structuring |

| Must-Have | Soft Skills | Relationship Management, Communication, Judgment, Resilience |

| Nice-to-Have | Technical | Python, SQL, Bloomberg, FactSet, Fund Accounting Software |

| Differentiator | Certification/Education | CFA, FRM, MBA |

Explore Specialized Niches: Direct Lending, Real Estate Debt, Special Situations

India's private credit industry is expanding quickly, opening up a wide range of career options in private credit. Each sector offers distinct experiences, skill requirements, and compensation profiles, ranging from high-risk distressed debt to mid-market direct lending. Here is a thorough examination of the primary private credit niches.

The largest segment (more than 75% of capital) is direct lending

What You'll Do: Direct lending entails giving mid-market businesses with EBITDA between $25 million and $500 million first-lien, second-lien, unitranche, and mezzanine debt, especially those that are unable to access bank syndicates.

Sectors: fintech, logistics, healthcare services, specialized manufacturing, software/SaaS, and business services.

Pay: In private credit, direct lending continues to be the highest-paying category. VP-level professionals can earn ₹60–80 LPA base, plus bonuses, reflecting the volume of capital deployed.

Career Appeal: Professionals who thrive on complex transactions and direct lending jobs will find this fast-paced, deal-rich, and highly technical field ideal.

Real Estate Debt: Growing Segment (25%+ of India Market)

What You'll Do: Finance construction projects, bridge loans for development, and permanent loans post-completion. Analysts evaluate property valuations, project IRR, and tenant quality.

Sectors: Logistics parks, data centers, residential construction, commercial real estate, and hospitality.

Pay: VP-level positions usually pay between ₹50 and ₹70 LPA. Real estate debt provides long-term portfolio exposure, albeit at a slightly lower cost than direct lending.

Special Situations / Distressed Debt: High Risk, High Reward

What You'll Do: Restructure underperforming borrowers, buy debt or equity from troubled businesses, and, if necessary, liquidate collateral.

Sectors: Consumer goods, retail, distressed real estate, and cyclical manufacturing.

Compensation: Due to the high variance and 20%+ returns on successful deals, it may be the highest in private credit.

Venture Debt: Emerging Segment (5% Market)

What You'll Do: Use quasi-equity instruments with downside protection to offer venture-backed startups bridge financing in between funding rounds.

Sectors: E-commerce, deep tech, fintech, and software/SaaS.

Pay: Moderate because AUM is lower, but portfolio-driven rewards are produced by a high deal volume.

Global Private Credit Market Size Visualization

The US dominates the global private credit market with a 70% share, followed by Europe and Asia-Pacific with respective shares of 15%. India's remarkable 53% YoY growth, far exceeding the US and Europe, which average about 8%, is highlighted in a special callout, highlighting India's emergence as the world's fastest-growing private credit market.

Assess Geographical Opportunities: India, APAC, US, Europe

Professionals wishing to pursue careers in private markets must take into account regional differences as the private credit market grows internationally. Growth opportunities, pay, career paths, and deal experiences vary by region. Navigating private credit fund roles globally requires an understanding of these distinctions.

| Region | Market Size / AUM | Growth Rate | Entry Salary | VP Salary | Pros | Cons |

|---|---|---|---|---|---|---|

| India | $9B (H1 2025) | 25–30% YoY | ₹12–16 LPA | ₹50–75 LPA (₹100+ LPA top funds) | Fastest growth, rapid promotions,first-mover advantage | Smaller deals, nascent secondaries, concentrated LPs |

| APAC | $200–300B | 10–15% YoY | SGD 80–110K / HKD 600–800K / AUD 90–120K | SGD 300–500K / HKD 2–3M / AUD 250–400K | Regional hub, established deals, competitive pay | Higher cost of living, limited early-stage exposure |

| US | $1.1T | 8–12% YoY | $70–100K all-in | $250–400K+ all-in | Largest deal flow, mature secondaries, top-tier platforms | Highly competitive, slower promotions, market saturation |

| Europe | $487B | 8–10% YoY | €60–80K (€70–100K all-in) | €200–300K+ all-in | Stable growth, regulatory frameworks, quality of life | Slower deal flow, lower risk/return appetite |

Private credit has great career potential everywhere, but the ideal location will depend on your priorities. The US offers the highest pay but fierce competition, APAC offers balance and regional mobility, Europe places a premium on stability and quality of life, and India offers unparalleled growth and quick promotions. Make a decision based on your preferences for lifestyle, global exposure, pay, or speed.

Position Yourself to Break Into Private Credit

How individuals with backgrounds in banking, PE/IB, auditing, and non-finance can move into one of the fastest-growing investment positions in 2025.

Globally, private credit is growing at a rate never seen before, generating thousands of new jobs and, crucially, lowering barriers to entry. However, you must properly position your background if you want to make an impact. A thorough guide with target roles, strategies, and expected pay for various career paths can be found below.

| Background | Why You're Valuable | How to Position Yourself | Target Roles | Compensation Lift | Special Advantage |

|---|---|---|---|---|---|

| Banking (RMs & Credit Officers) | • Corporate relationships • Deal execution & loan structuring • Understanding covenants & borrower risk | • Emphasize origination & client coverage • Highlight mid-market exposure • Quantify deal wins (sourced/closed) • Frame bank constraints vs. private credit agility | • Relationship Manager (Direct Lending) • Investment Analyst / Credit Analyst | • Current: ₹16–22 LPA • With strong positioning: ₹18–24 LPA | Can skip junior analyst level with strong track record |

| Private Equity / Investment Banking | • Full deal-cycle experience • Advanced modeling (LBO, debt sizing) • Exposure to sponsors & lenders | • Shift equity → credit narrative • Stress modeling rigor • Leverage sponsor relationships | • Investment Analyst • Senior Analyst (skip entry level) | • Typical: ₹16–22 LPA • Usually start as Senior Analyst | 2–3 year head start vs. banking laterals |

| Audit & Accounting (Big 4, FS Advisory) | • Deep financial statement analysis • Detect financial red flags • Strong compliance rigor • Tax & structuring knowledge | • Highlight analytical depth • Frame as progression: audit → investing • Leverage tax/structuring experience | • Fund Operations • Credit Analyst • Financial Analyst | • Fund Ops: ₹14–18 LPA • Credit Analyst: ₹12–16 LPA | Clear pathway: Operations → Analyst → Senior Analyst in 2–3 years |

| Any Background (Operations Route) | • Learn full fund infrastructure • NAV, compliance, LP reporting • Trusted internally for process knowledge | • Position yourself as a learner-builder • Build strong internal relationships • Show readiness for investing track | • Fund Operations (entry) • Credit Analyst / Associate (Year 3–4) | • Ops: ₹12–14 LPA • Analyst after rotation: ₹18–25 LPA | Easiest entry route for career changers; validated path to investing |

Emphasize your relevant deal experience, analytical rigor, and internal relationships regardless of your background. Customize your story to highlight your preparedness for credit-specific roles, demonstrate how your skills translate to private credit, and take advantage of any early advantages to speed up entry and pay growth. While banking and PE experience can bypass junior levels with strong positioning, operations backgrounds provide the easiest entry path.

Conclusion

Private credit is becoming one of the most attractive growth areas in finance, and India's momentum is creating more analyst-level openings, faster learning curves, and earlier responsibility across direct lending, real estate debt, and special situations. The hiring funnel is also widening, so candidates from banking, PE/IB, audit, and operations can break in through multiple entry routes and build durable skills in credit analysis, deal structuring, and portfolio management.

If you want to move from interest to action, start by choosing a target role track and preparing one strong credit memo with a downside case, key risks, and a proposed covenant package, then use it to drive conversations and referrals with private credit teams. If you're serious about breaking into private credit, start by strengthening your credit and risk foundations through Aswini Bajaj Classes' CFA and FRM coaching, along with practical upskilling courses. It will help you build the modeling and credit-thinking recruiters actually test.

F A Qs :

Q: What is private credit in simple terms?

A: It's lending by non-bank investors through privately negotiated loans, rather than public bonds or traditional bank loans.

Q: Is "direct lending" the same as private credit?

A: Direct lending is a major part of private credit, usually involving a fund negotiating a loan directly with a borrower (sometimes with a small lender group).

Q: What do private credit analysts actually do?

A: They model cash flows, test downside scenarios, write credit memos, and support diligence and monitoring for loans.

Q: Why do regulators talk about risks in private credit?

A: Concerns often include leverage, limited transparency versus public markets, and how losses could transmit through connected lenders and borrowers.

Q: What background helps most for private credit jobs?

A: Roles that build credit judgment and modeling like leveraged finance, corporate banking/credit, investing research, or even fund operations tend to transfer well.

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj