CFA Salary in India 2025-2026: Guide for Aspirants

With the growing popularity of the Chartered Financial Analyst (CFA) certification, India's finance ecosystem has expanded across public markets, private equity (PE)/venture capital (VC), wealth, and fintech. As a result, there has been a steady demand for analysts with portfolio management skills, market understanding, and deep valuation expertise. This CFA compensation study examines the progression from fresher to charterholder at the level-wise journey and how the value varies across roles, industries, experience, and locations. It will help aspiring candidates make informed decisions and plan realistic targets in India.

The average salaries can also vary depending on the levels cleared at CFA Level 1, Level 2, or Level 3. However, the most significant spikes usually occur post-level 3 in buy-side and front-office roles. The following data and salary figures are based on various broad-based sets of industry articles and role-based salary snapshots, which were used to arrive at an approximate value.

Looking forward to pursuing CFA? If investment research or portfolio roles are your goal, consider CFA coaching to align your preparation with hiring cycles.

CFA Salary Guide India: A Level-Wise Breakdown

At Levels 1 and 2, job professions tend to overlap across research, credit, and analytical roles, especially during early-career transitions. However, one can expect an immediate uplift after Level 3 when candidates transition from associate-level analysis to higher-responsibility roles, such as senior analyst, product specialist, or portfolio-track seats. They can also expect an exponential increase in both base and variable pay at India's top finance hubs.

Average Salary Package of CFA in India

| CFA Level | Typical Roles | Annual Salary (LPA) | CFA Monthly Salary (₹) |

|---|---|---|---|

| Level I | Research Analyst, Junior Associate | ₹4–6 LPA | ₹33k–₹50k |

| Level II | Equity Analyst, Credit Analyst | ₹6–9 LPA | ₹50k–₹75k |

| Level III/Charterholder | Senior Analyst, Portfolio-Track | ₹10–25 LPA+ | ₹83k–₹2.1L+ |

CFA Level 1: Some of the typical entry roles include junior associate, research analyst, and valuation/data roles. A realistic band is around ₹4–6 LPA, although Tier-2 entry points can start nearer ₹3–4.5 LPA. In overview, it roughly translates to a ₹33,000–₹50,000 per month as a planning anchor for a CFA fresher's salary.

CFA Level 2: After passing level 2, candidates can progress into equity or credit analyst roles with good bands at ₹6–9 LPA, with metros and front-office teams skewing higher – particularly where firms reward modelling, coverage depth, and writing/pitch quality.

CFA Level 3: After becoming a charterholder, the typical salary range widens to ₹10–25 LPA+, with experienced professionals surpassing ₹30–50 LPA in top teams. As a result, the long-run upside reflects team performance, desk, and bonus practices in asset management (AM) / investment banking (IB) / private equity (PE) rather than the credentials alone.

Industry and Location Impact on CFA Salaries

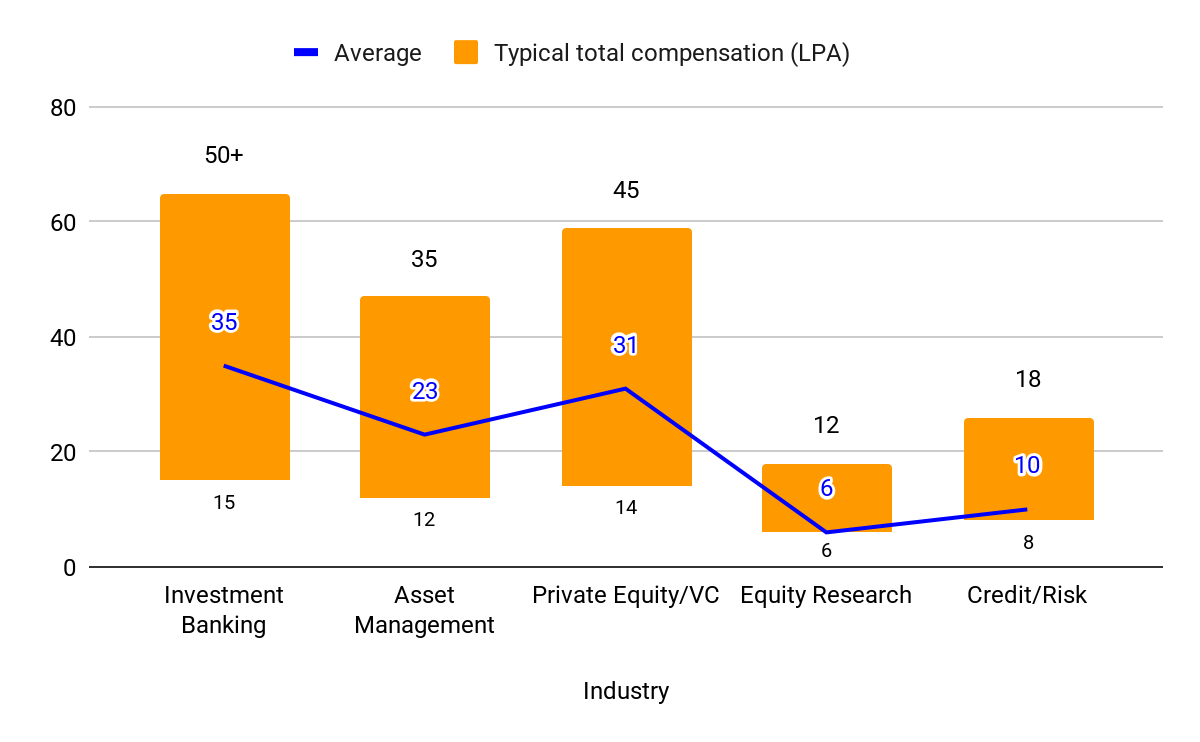

The type of industry matters significantly, as investment banking, asset management, and private equity typically offer a higher base and potentially much higher variable compensation. In comparison, credit rating, financial planning and analysis, or middle office, have lower (but still reasonable) base ranges. The statement holds especially true for mid-to-senior tenures in India. Here is a detailed breakdown of the range.

Industry-Wise CFA Salary Range

| Industry | Typical Total Compensation (LPA) |

|---|---|

| Investment banking | ₹15–50 LPA+ |

| Asset management | ₹12–35 LPA |

| Private equity/VC | ₹14–45 LPA |

| Equity research | ₹6–12 LPA |

| Credit/risk | ₹8–18 LPA |

Apart from industry, company size also plays a significant role. You will find that established private equity platforms, global AMCs, and multinational banks usually pay more than small boutiques or startups on fixed pay. However, some startups can compensate with faster growth in responsibility and equity. Hence, candidates must benchmark both base and bonus potential by desk, not just headline salaries, when comparing offers.

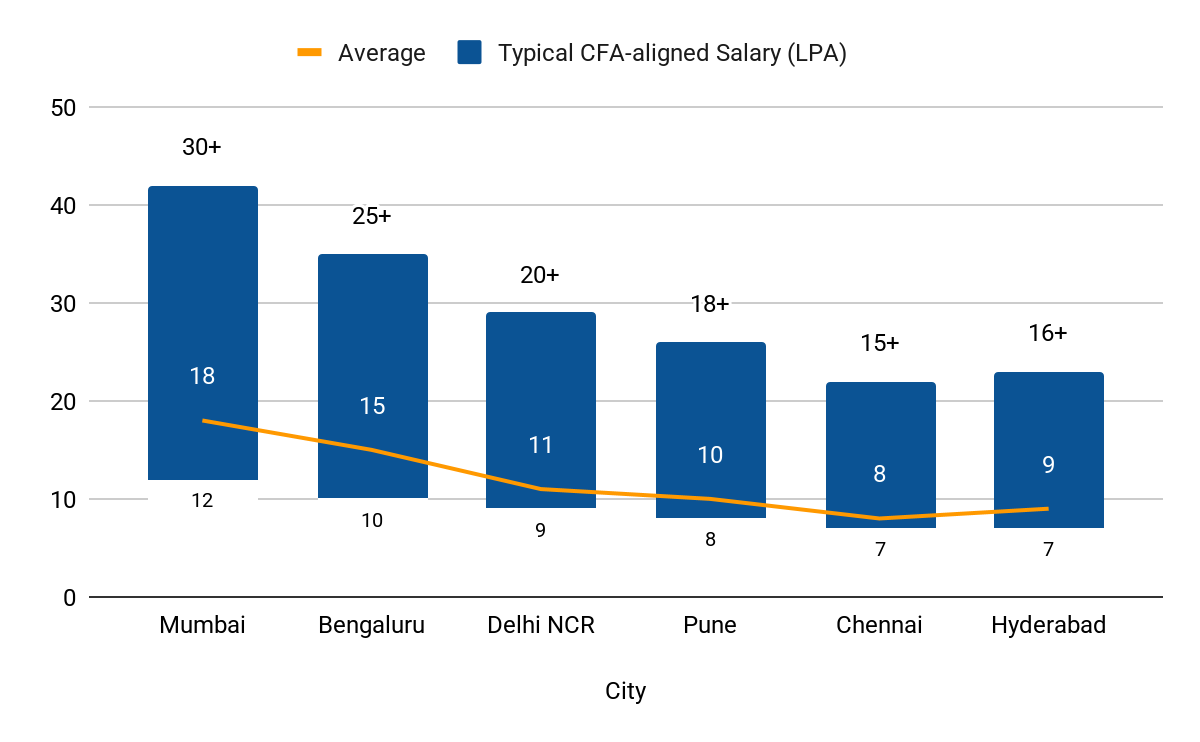

Subsequently, cities are an additional factor in these CFA salary ranges, as Mumbai often offers 10-20% above national ranges, with Delhi NCR and Bengaluru following close behind. In comparison, Tier-2 cities pay less on average per comparable role. Here are some indicative CFA salary ranges across popular cities.

City-Wise CFA Salary Range

| City | Typical CFA-aligned Salary (LPA) |

|---|---|

| Mumbai | ₹12–30 LPA |

| Bengaluru | ₹10–25 LPA |

| Delhi NCR | ₹9–20 LPA |

| Pune | ₹8–18 LPA |

| Chennai | ₹7–15 LPA |

| Hyderabad | ₹7–16 LPA |

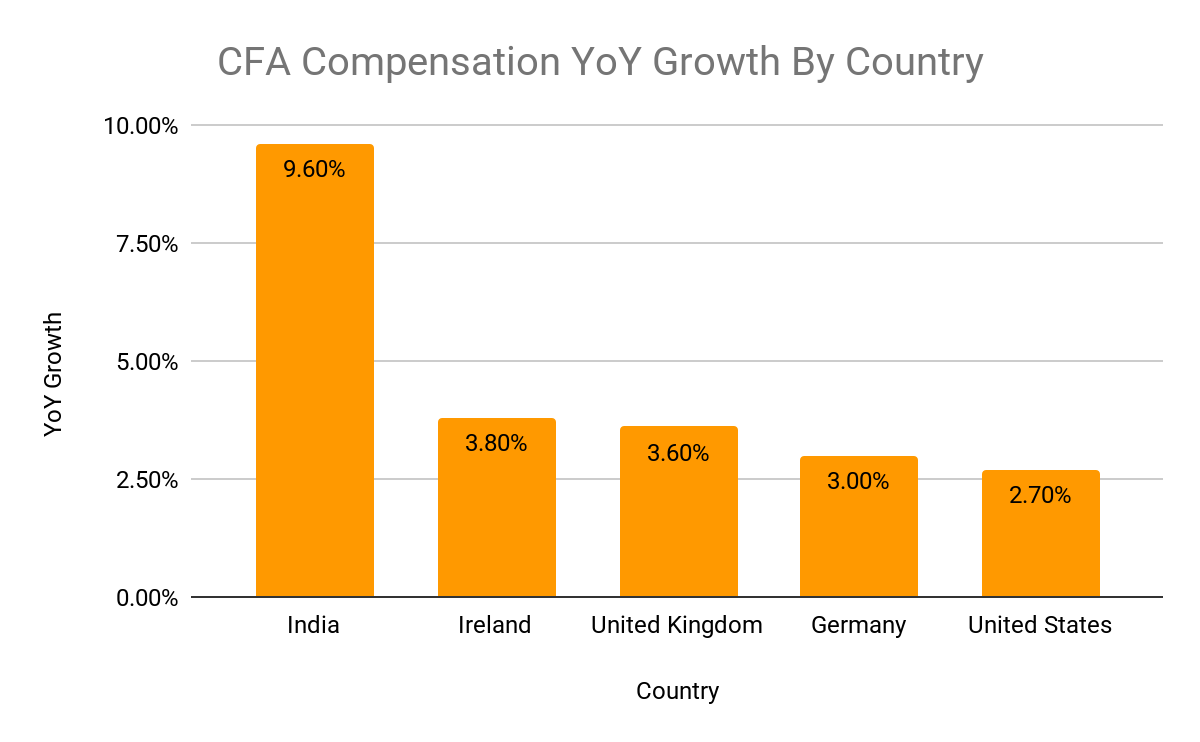

Growth Momentum for CFA Salaries in India 2025-2026

According to the CFA Compensation Study 2024, India led year-on-year base salary change at 9.6% among more than 100 respondents in the 2024 cycle. In comparison, the United States reflected an increase of 2.7%, Germany reflected 3.0%, the United Kingdom reflected 3.6%, and Ireland reflected 3.8%. As a result, India is expected to show promising growth heading into the 2025-2026 recruiting and review seasons for CFA-aligned roles.

Comparison with Other Certifications

The CFA certification places great emphasis on valuation, markets, and portfolio roles with strong signalling to buy-side teams. In comparison, other certifications, such as FRM, MBA, CA, CPA, and ACCA, focus on different areas. However, when combined with CFA, these certifications can help increase outcomes and credibility in various roles. Let's explore this in more detail below.

CFA vs FRM Salary

Focus and Roles:

- CFA skews toward investment analysis, equity/credit research, and portfolio and product management.

- FRM focuses primarily on market/credit/operational/treasury risk, as well as model risk, across banks, Asset Management Companies (AMCs), and Global Capability Centres (GCCs) in India.

Salary Ranges (Indicative):

CFA:

- Entry-level jobs cited a range of ₹6–12 LPA

- Mid-level being ₹13–25 LPA

- Senior-level roles reflecting ₹26–50 LPA+ in top teams with higher bonuses in IB/AM/PE roles.

FRM:

- Entry-level salaries cited a range of ₹9–12 LPA

- Senior roles reported ₹20–30 LPA or more. Some roles also reflected a range of ₹18–33 LPA in certain risk tracks, depending on the bank and experience.

CFA vs MBA Salary

Focus and Roles:

- CFA aligns with equity/credit research, portfolio management, product/strategy on the buy side.

- The MBA (Finance) program encompasses corporate finance, investment banking, consulting, and leadership tracks, with a focus on securing Tier-1 placements in India.

Salary Ranges (Indicative):

CFA:

- Level 1 between ₹4–6 LPA

- Level 2 between ₹6–9 LPA

- Level 3/Charterholder between ₹10–25 LPA+. Moreover, seasoned leaders can easily surpass ₹30–50+ LPA where variable pay is meaningful.

MBA:

- Freshers from reputable institutions often report median salaries of ₹12–20 LPA, with elite institutions like IIM/ISB reporting higher bands.

- In some instances, front-office investment banking/consulting can exceed ₹20 LPA plus bonuses at top schools.

CFA vs CA

Focus and Roles:

- CFA: Centres on investment analysis and portfolio roles with a stronger signal for buy-side/sell-side investment roles.

- CA: Specialises in accounting, audit, assurance, and tax. In India, CA dominates statutory and corporate accounting tracks.

Salary Ranges (Indicative):

CFA:

- Standard entry bands range from ₹4–6 LPA to ₹10–25 LPA+ at the charterholder level.

- Accordingly, top-end outcomes in investment banking/asset management/private equity leadership exceed ₹30–50 LPA, with variable pay, and select roles reach ₹1 crore+ over time.

CA:

- New CAs may get around ₹8–15 LPA.

- Mid-level ₹15–25 LPA

- Senior leadership/partner tracks ₹25–50 LPA+, with partners or owners potentially reaching ₹40 LPA to ₹1 crore+ depending on practice scale.

CFA vs CPA

Focus and Roles:

- CFA: Focus on markets and investments, aligning with research, asset management, and investment banking.

- CPA: Focused on accounting/financial reporting/audit-heavy (particularly US Generally Accepted Accounting Principles (GAAP) / The Sarbanes-Oxley Act (SOX) environments. In India, CPA aligns with Big 4, GCCs, and US-focused controllerships.

Salary Ranges (Indicative):

CFA:

- The average range is often cited as approximately ₹8 LPA, scaling to ₹15–20 LPA for mid-level and higher roles in front-office teams, with senior roles having wider dispersion due to bonuses and LTIs.

CPA:

- Average ₹7 LPA with senior roles citing between ₹20–30 LPA in some aggregations. They also enjoy growth with MNC/Big 4 roles.

CFA vs ACCA

Focus and Roles:

- CFA: Preferred for research, asset management and Investment banking, covering investments and portfolios.

- ACCA: Spans accounting, audit, and advisory. In India, ACCA is increasingly used in shared services/Big 4 and corporate finance.

Salary Ranges (Indicative):

CFA:

- Entry to mid-level positions is often higher in front-office teams, with many salary guides citing ₹6–8 LPA averages, scaling to ₹15–25 LPA+ in investment roles, where senior ranges widen due to bonuses.

ACCA:

- Freshers enter into positions with a range of ₹3–8 LPA

- Mid-level ₹11–17 LPA

- Senior roles ₹19–30+ LPA depending on the firm/city. However, Big 4 tracks have clearer ladders.

CFA vs FRM, MBA, CA, CPA, ACCA Roles & Salaries (India, Indicative)

| Aspect | CFA | FRM | MBA (Finance) | CA | CPA | ACCA |

|---|---|---|---|---|---|---|

| Focus & Roles | Investment analysis, equity/credit research, portfolio & product roles; buy-side & sell-side | Market/credit/operational/treasury risk, model risk across Banks, AMCs, GCCs | Corporate finance, IB, consulting, leadership tracks (esp. Tier-1 B-schools) | Accounting, audit, assurance, tax; statutory & corporate finance | Accounting, financial reporting, audit (US GAAP/SOX), Big 4 & GCCs | Accounting, audit, advisory, corporate finance; popular in Big 4/shared services |

| Entry Salary | ₹4–6 LPA (L1); ₹6–12 LPA in some tracks | ₹9–12 LPA | ₹12–20 LPA (higher for IIM/ISB) | ₹8–15 LPA | ~₹7 LPA | ₹3–8 LPA |

| Mid-Level Salary | ₹10–25 LPA (Charterholder/Level 3) | ₹18–25 LPA | ₹20+ LPA (IB/Consulting higher) | ₹15–25 LPA | ₹15–20 LPA | ₹11–17 LPA |

| Senior Salary | ₹26–50+ LPA (IB/AM/PE leaders often >₹1 Cr with bonuses) | ₹20–30+ LPA, some tracks ₹33 LPA | ₹25–50+ LPA depending on firm/role | ₹25–50+ LPA, Partners/Owners ₹40 LPA–₹1 Cr+ | ₹20–30 LPA (Big 4/MNC senior roles) | ₹19–30+ LPA (Big 4/corporates) |

Additional Combined-Path Insights

Most candidates are also curious about CFA salaries in combination with other certifications, as mentioned above. According to consolidated reports from multiple sources, here is an indicative figure based on that data:

CFA + FRM:

- Entry-level ranges between ₹6–10 LPA

- Mid-level ₹12–20/25 LPA

- Senior-level ₹25–50 LPA+, with banks and asset management companies showing meaningful variable pay in treasury, market/credit risk, and investment risk seats. Additionally, the range widens by desk and city.

CFA + MBA:

- Freshers can earn a starter salary between ₹15–25 LPA

- Mid-level ranging between ₹18–32 LPA

- Senior roles ranging between ₹35–48 LPA, where MBAs (Tier-1) unlock placements and CFA certification helps deepen credibility in investment banking, asset management, and private equity. Moreover, the upside expands with bonuses/LTIs in front-office seats.

CFA + CA:

- When combined with CA, the role's focus moves into investment roles with entry salaries starting between ₹8–12 LPA

- Mid-level ranging between ₹15–28 LPA

- Senior-level ranging upwards of ₹30–50 LPA+. One can expect top-end outcomes in equity/credit research, as well as buy-side roles, where forensic financial statement analysis is highly valued. Upside depends on a successful desk transition.

CFA + CPA:

- CPAs often offer packages with entry-level salaries of ₹7–10 LPA.

- Mid-level ₹15–25 LPA

- Senior-level ₹30–35 LPA. Combining it with CFA can enhance prospects for equity/credit coverage, as well as investment roles, through stronger valuation/storytelling, particularly in US-GAAP-heavy or global firms.

CFA + ACCA:

- ACCA bands in India commonly cite ₹4–8 LPA for entry-level

- ₹11–17 LPA for mid-level

- ₹19–37 LPA for senior-level roles. Combining it with CFA can enhance outcomes when transitioning to equity/credit research or buy-side analysis. Moreover, the combined path premium is evident mainly after the role shift, rather than as an additive credential alone.

Joint Salary Ranges – CFA + Other Certifications (India, Indicative)

| Combo | Entry-Level | Mid-Level | Senior-Level | Notes / Role Focus |

|---|---|---|---|---|

| CFA + FRM | ₹6–10 LPA | ₹12–20/25 LPA | ₹25–50 LPA+ | Strong fit for banks & AMCs; treasury, market/credit/operational risk, investment risk; variable pay depends on desk & city. |

| CFA + MBA | ₹15–25 LPA | ₹18–32 LPA | ₹35–48 LPA+ | MBAs (Tier-1) open placements; CFA adds credibility in IB, AM, PE; upside expands via bonuses/LTIs in front-office roles. |

| CFA + CA | ₹8–12 LPA | ₹15–28 LPA | ₹30–50 LPA+ | Shifts CA career into investment-focused roles (equity/credit research, buy-side); forensic financial analysis valued. |

| CFA + CPA | ₹7–10 LPA | ₹15–25 LPA | ₹30–35 LPA | Advantage in US-GAAP-heavy/global firms; CFA adds value for equity/credit coverage & valuation skills. |

| CFA + ACCA | ₹4–8 LPA | ₹11–17 LPA | ₹19–37 LPA | CFA lifts ACCA into research/buy-side analysis; premium realized after transition rather than immediately additive. |

Conclusion

The level-wise salary expectations for CFA aspirants in India are roughly ₹4–6 LPA at Level 1, ₹6–9 LPA at Level 2, and ₹10–25 LPA+ at Level 3/charterholder, with ₹30–50 LPA+ achievable for high performers. Moreover, higher brackets are possible in choosing senior investment roles over time in India's top markets. Aspirants who pair curriculum mastery with internships, demonstrate depth, possess strong writing/pitching skills, and target smart cities and desks tend to experience faster career acceleration and better resilience through market cycles in India.

Frequently Asked Questions (FAQs)

What is the starting salary of a CFA?

For entry-level roles aligned to Level I, typical bands range from ₹3–6 LPA, translating to a CFA salary per month in India of roughly ₹25,000–₹50,000, depending on the role, city, and employer tier. Performance bonuses may be limited at this stage and increase with responsibility.

In which country is CFA highly paid?

Compensation is typically highest in major financial hubs, such as the United States and the United Kingdom, followed by markets like Hong Kong SAR and Singapore. The total pay reflects base, bonus, and long-term incentives in front-office roles.

Is CFA worth it in India?

Yes—particularly for investment-facing roles (such as equity research, portfolio management, investment banking, private equity, and asset management), where the charter signals rigorous skills and ethics. Compensation typically increases after Level III, with variable pay driving long-term upside.

Which field is best for CFA?

Portfolio management, equity/credit research, investment strategy, and buy-side roles (asset management, personal equity/venture capital) align most closely with the curriculum and offer clearer pathways to performance-linked pay growth.

Which CFA has the highest salary?

Senior charterholders in leadership or high-performing teams (e.g., portfolio managers, IB/PE leaders, hedge funds) tend to have the highest compensation due to substantial bonus/LTI potential. The outcomes depend on role, team results, and market.

Citations:

- CFA Compensation Study 2024 - CFA Institute

- CFA Institute FY2024 Annual Report

- CFA Institute Insights hub

- Salary Data from CFA Charterholder Surveys (India)

- Glassdoor India

- AmbitionBox

- RBI Financial Sector Reports

- World Bank India Data

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj