FRM Fees & Registration 2026: Complete Cost Breakdown, Scholarships & Deadlines

The FRM (Financial Risk Manager) certification is one of the most respected credentials in the field of finance, specializing in risk management. Risk is everywhere, whether it is operational or financial, like credit, market, or investment-related, which ultimately leads to a rising demand for skilled professionals in banks, investment firms, and multinational corporations.

Key Takeaways

-

- Budget for FRM like a two-part project - the "headline fee" is only one component while your real cost depends mostly on when you register (early vs standard) and what you spend on prep.

- The one-time enrolment fee + per-part exam fees are predictable (USD-based), so your biggest lever is simple. Register early and avoid last-minute decisions that force higher pricing.

- Scholarships for FRM are not broadly available to everyone in the same way some other credentials offer; the practical route is via GARP Academic Partners, so eligibility is institution-linked, not purely need-based.

- Deferrals and timeline rules can become "hidden costs" if ignored—treat deadlines as part of your financial planning, not an admin detail.

- Optional membership benefits exist, but ROI is personal: if you're not going to actively use networking/resources, membership is usually the first cost to cut.

Candidates need to be aware of the FRM exam syllabus, as well as the associated fees. Understanding the FRM fees for Parts 1 and 2, as well as scholarship opportunities and the registration process, is crucial for planning your finances and ensuring a smooth preparation journey.

This comprehensive guide will help you navigate the cost structure for the FRM exam, explore available scholarships, and give you actionable insights to save money while pursuing this valuable certification.

FRM Fees Structure

One-Time Enrollment Fee

The FRM exam requires a one-time enrollment fee of $400 (~₹35,000), which is only paid during your first registration for Part 1. After this, only the exam fees are applicable for subsequent attempts.

FRM Exam Fees:

| Fee Type | Amount in USD | INR (Estimate) |

|---|---|---|

| One-time Enrollment | $400 | ₹35,000 |

| Part 1 Registration | $600 (Early) $800 (Standard) | ₹52,000 ₹70,000 |

| Part 2 Registration | $600 (Early) $800 (Standard) | ₹52,000 ₹70,000 |

| Study Materials | $200–$500 | ₹17,000–₹44,000 |

| GARP Membership (Opt.) | $195/year | ₹16,000 |

| Retake/Scheduling Fees | As per the registration fee | — |

Additional Costs to Consider:

-

- Study Materials: These can range from $200 to $500, depending on the provider and whether you opt for official or third-party materials. Check out Aswini Bajaj Classes FRM course page for details.

- Optional GARP Membership: You can become a member of the Global Association of Risk Professionals (GARP) for $195/year. Membership offers benefits like access to exclusive thought leadership content, global networking opportunities, and priority entry to GARP chapter events. Members also enjoy discounted rates on programs, career resources, and access to premium tools like the Pillar 3+ Lite Platform and GARP Learning.

- Retake Fees: If you need to retake the exam, additional fees will apply.

- Deferral Fees: If you wish to change your exam session, the deferral fee is $250.

Important Notes:

-

- Take the FRM Part 2 exam by December 31st of the 4th year after passing FRM Part 1.

- Submit 2 years of relevant work experience in financial risk management within 10 years of passing FRM Part 2.

- Work experience up to 10 years before passing both exams counts.

- Miss the deadline? You'll need to re-enroll, pay all fees, and retake both FRM Part 1 and Part 2 exams.

Also check out the latest FRM Part 1 & 2 Syllabus changes.

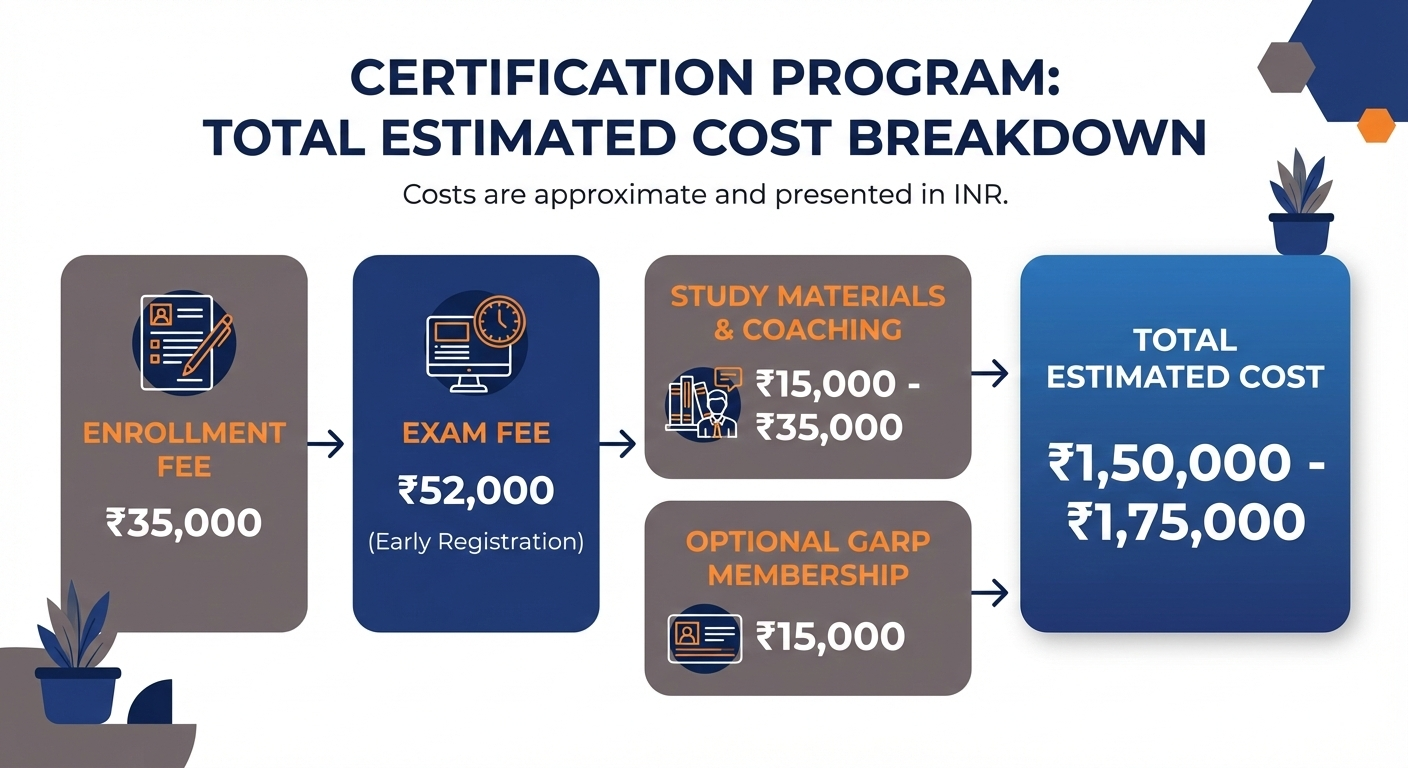

Total Estimated Cost

The registration fees for FRM Part 1 and Part 2 remain unchanged in 2026. There are three exam sessions - May, August, and November. Candidates can take both parts in the same session, and in August, on the same day. Considering a candidate taking both parts in the same exam session, registering early, plus exam preparation expenses including coaching, study materials, etc., the total estimated investment ranges from ₹1,50,000–₹1,75,000.

Here's how the breakdown looks:

Tips to Reduce Costs:

-

- Use third-party prep materials if you're on a budget. Many reliable sources offer quality content at a fraction of the cost of official materials.

- Register early to save on registration fees.

- Consider skipping GARP membership unless you need it for networking or discounts.

FRM Scholarship Application: What You Need to Know

GARP provides scholarships to students and faculty, but is limited to their Academic Partners. Therefore, there is no direct scholarship program like the CFA Access Scholarship, which is offered to financially needy and meritorious candidates by GARP.

GARP offers the Academic Partnership program, where they help universities and colleges to improve their risk management course offerings to meet the demands of the global financial industry. The benefits of becoming an Academic Partner are:

-

- Scholarships

- Networking

- Membership Discounts

- Reduced Ad Rates

- Program Materials and Discounts

- Cross-Promotional Materials

There are three Indian Institutes that are listed as GARP's Academic Partners.

| Institute Name | Location | Program (Affiliate Partnership) |

|---|---|---|

| T.A. Pai Management Institute (TAPMI) | Manipal, Karnataka | PGDM - Banking and Financial Services |

| Xavier School of Management (XLRI) | Jamshedpur, Jharkhand | PGDM (General Management/Risk Management) |

| XIM University | Bhubaneswar, Odisha | Master's in Business Finance (MBF)/MBA |

If you're a part of any of the above institutes, you may have the chance to get a scholarship.

Apart from these three, there are other institutions from different countries in the Academic Partner List.

| Institute Name | Location | Program (Affiliate Partnership) |

|---|---|---|

| Bentley University | Waltham, MA, USA | MS in Finance |

| Brandeis University | Waltham, MA, USA | MS in Finance |

| EDHEC Business School | France | MSc in Financial Engineering |

| Frankfurt School of Finance & Management | Frankfurt, Germany | Master's in Finance |

| Fordham University | New York, USA | MS Quantitative Finance |

| IESEG School of Management | Lille/Paris, France | MSc in Finance |

| SDA Bocconi | Milan, Italy | Master's in Corporate Finance |

| Singapore Management University | Singapore | MSc in Applied Finance |

| Trinity Business School | Dublin, Ireland | MSc in Financial Risk Management |

| University of Reading | Reading, UK | MSc in Financial Risk Management |

| University of St. Gallen | St. Gallen, Switzerland | Master's in Banking and Finance |

| University of Strathclyde | Glasgow, UK | MSc in Financial Risk Management |

| Monash University | Melbourne, Australia | Master of Advanced Finance |

| Baruch College (CUNY) | New York, USA | MS in Financial Risk Management |

| Chinese University of Hong Kong | Hong Kong | MSc in Risk Management Science |

| University of Hong Kong | Hong Kong | MSc in Financial Engineering |

| HEC Liège Management School | Liège, Belgium | MSc in Financial Engineering |

| Kozminski University | Warsaw, Poland | Master's in Finance & Accounting |

| SKEMA Business School | Paris, France | MSc in Financial Markets & Investments |

Is FRM Costly? Investment vs Value?

Financial Risk Management (FRM) is a globally recognized designation in the field of finance. To pursue the FRM certification, it's true that a significant investment is required, which can ultimately lead to added value in the future through career growth and numerous opportunities. While the FRM fees may seem high, they are justified when considering the potential career salary uplift.

Here comes the importance of understanding the scope of FRM.

Target Industries:

Banking, financial institutions, fintech, credit rating agencies, and energy companies, data risk, and IT (especially with AI and risk analytics), where risk management is crucial.

Career Growth Potential:

-

- Salary expectations vary widely depending on experience, knowledge, and industry demand, with some earning 10X more than others.

- The growth in fintech and financial risk management roles is significant, offering lucrative opportunities for those who can integrate risk models with finance.

Cost Comparison with Other Finance Certifications:

| Certification | Average Exam Fees | Average Salary Post-Certification |

|---|---|---|

| FRM | ₹1,50,000 - ₹1,75,000 | ₹12,00,000 - ₹20,00,000+ |

| CFA | ₹1,00,000 - ₹1,50,000 | ₹10,00,000 - ₹15,00,000+ |

| PRM | ₹1,00,000 | ₹9,00,000 - ₹14,00,000+ |

How to Budget for the FRM Exam

-

- Always start preparing early and register in the early bird window to save on the registration fees.

- Instead of the official study materials, choose an affordable prep provider. Schweser textbooks can be an inexpensive option to prepare at a low cost.

- Look for a scholarship if you're part of any of their Academic Partner institutes.

Value Beyond the Cost:

While the FRM exam can be costly, its return on investment (ROI) is significant, considering the lucrative job opportunities it can unlock. The GARP institute does not offer campus placements like an MBA, but having FRM certification offers value through industry recognition, specialized risk management knowledge, and the ability to apply real-world risk concepts. Resume development and networking play a major role in securing high-paying roles after completing FRM.

Conclusion

Understanding the FRM fees, scholarship opportunities, and registration process is key to preparing effectively for the FRM exam. With the right study plan, early registration, and financial planning, you can make the most out of your FRM journey.

Start early, explore scholarship opportunities if eligible, and approach the FRM exam as an investment in your career. The certification offers a high ROI in terms of both career progression and salary growth.

Explore the FRM prep programs at Aswini Bajaj Classes to get started on your path to becoming a Financial Risk Manager.

F A Qs :

Q: What is the fee for FRM?

A: The FRM fees for Part 1 and Part 2 range from $600 to $800 for early and standard registration, respectively.

Q: What is the FRM scholarship?

A: The FRM scholarship helps reduce the financial burden for deserving candidates based on academic achievements and financial need. Application processes are available on the GARP website.

Q: How much does FRM cost?

A: The FRM exam costs approximately ₹1,50,000 to ₹1,75,000 when accounting for registration fees, study materials, and optional membership.

Q: Is FRM costly?

A: While the FRM certification has upfront costs, it provides substantial returns in terms of career advancement and salary increases, making it a valuable long-term investment.

Q: How to apply for FRM scholarships?

A: You can apply for the FRM scholarship by visiting the GARP website, submitting the required documents, and completing the application form.

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj