The best way to prepare for FRM

What is FRM ?

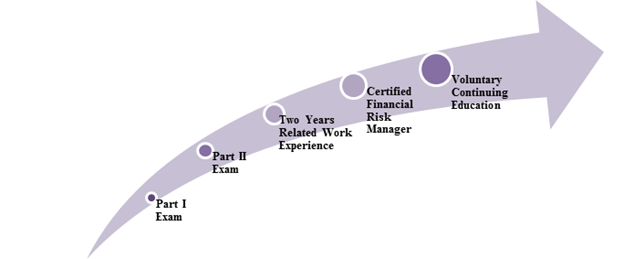

When you start to prepare for FRM, it is important to know what FRM is. The Financial Risk Manager (FRM) designation is a professional certification offered by the Global Association of Risk Professionals (GARP). It is recognized globally and is considered one of the most prestigious certifications for financial risk professionals. The FRM program is designed to equip candidates with the knowledge and skills required to identify, analyze, and manage the various types of risk in the financial services industry.

Why FRM?

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses. FRMs are the guardians of financial stability, ensuring institutions navigate the ever-changing risk landscape. This translates to high demand and excellent career prospects.

Preparing for the Financial Risk Manager (FRM) exam is a rigorous process that requires a strategic approach, dedication, and a deep understanding of financial risk management concepts. The FRM certification is globally recognized and the FRM syllabus is divided into two parts: FRM Part I and FRM Part II. Each part demands a comprehensive study plan, a grasp of complex topics, and practical application of risk management tools. As you prepare for FRM, it's crucial to leverage various resources such as textbooks, online courses, study groups, and professional networks to ensure success in this challenging yet rewarding journey.

Decoding the FRM Certification

FRM Part I

- Focus: The foundational knowledge required for Risk Management.

- Topics and Weights:

- Foundations of Risk Management (20%)

- Quantitative Analysis (20%)

- Financial Markets and Products (30%)

- Valuation and Risk Models (30%)

- Format: 100 multiple-choice questions.

FRM Part II

- Focus: Applying the tools acquired in Part I, with a deeper dive into Market, Credit, Operational, and Integrated Risk Management.

- Topics and Weights

- Market Risk Measurement and Management (20%)

- Credit Risk Measurement and Management (20%)

- Operational Risk and Resiliency (20%)

- Liquidity and Treasury Risk Measurement and Management (15%)

- Risk Management and Investment Management (15%)

- Current Issues in Financial Markets (10%)

-

Format: 80 multiple-choice questions.

FRM Part I and II Comparison Table

| Section | FRM Part I | FRM Part II |

| Format | 100 MCQs, CBT, 4 hours | 80 MCQs, CBT, 4 hours |

| Focus | Foundations, Quant, Markets & Products, Valuation & Risk Models | Market, Credit, Operational & Resiliency, Liquidity & Treasury, RM & Investment, Current Issues |

| Weights | 20%, 20%, 30%, 30% | 20%, 20%, 20%, 15%, 15%, 10% |

Note: Candidates should review GARP's latest study materials and learning objectives; certain Part II areas like Market Risk and Current Issues see periodic updates.

A Simple Guide to Get Ready

-

Plan Ahead and Space Out Your Studies :

To succeed in your FRM exams, begin your preparation well in advance rather than leaving it to the last moment. Early planning allows you to:

-

Cover All Topics: Ensure you study every part of the curriculum without rushing.

Improve Retention: Spreading out your study sessions and revisiting material aids in better memory retention.

Allocate Sufficient Time: Allow ample time for in-depth study, review, and practice, which will enhance your understanding and performance.

-

-

Use a Study Plan for your FRM Exam Preparation :

Creating a study schedule from the beginning is a great way to stay organized and track your progress. It helps you stay on track, gradually increase your knowledge as the exam approaches, and lets you know if your job or other responsibilities are getting in the way of your FRM study time, which becomes especially important for working professionals.

-

Strategic Study Sequence :

It's crucial to consider the sequence in which you tackle topics when you prepare for FRM due to their interconnections. Begin with foundational topics like quantitative methods, as these concepts are pivotal throughout the study. Later, focus on more complex, content-heavy subjects such as advanced risk models. This allows for deeper concentration and better retention by recognizing the relationships between chapters. Organizing your studies this way ensures a thorough understanding of both primary and intricate topics, facilitating a more effective exam preparation.

-

Don't Skip Topics :

For professional exams with passing criteria like the FRM, which has 100 multiple-choice questions covering about 60 chapters, it's important not to skip any topics. Even if you feel confident in some areas, review every chapter to prepare thoroughly for the exam.

-

Questions Are Key :

Active practice is critical to learning. In addition to concentrating on lectures, continuous practice along with the chapters and not pushing it all to the end is recommended for getting the desired results.

-

Allocate Dedicated Study Time Before the Exam :

Consider taking 1-2 weeks off to dedicate to focused preparation before your exam. This dedicated period allows for undivided attention to practicing questions and thorough review, enhancing your readiness for the FRM examination.

-

Significance of Mock Tests :

Incorporating mock tests into your study routine is imperative for effective exam preparation. Start practicing with them at least two weeks before the exam to get used to the format and exam software, mimicking exam conditions. Understanding your mistakes is crucial for improvement. Initially, scores may be low, but with consistent practice, they will improve.

Scope of FRM

The scope of a FRM certification opens doors to a rewarding career in the financial risk domain. FRMs identify, measure, and manage risks for institutions across various industries, including banks, financial institutions, rating agencies, and non-banking financial companies (NBFCs), making them highly sought-after professionals. Common designations for FRM-certified individuals include Risk Analyst, Risk Manager, Credit Risk Manager, Market Risk Manager, Regulatory Risk Analyst, Operational Risk Manager, and Chief Risk Officer.

Conclusion

If you are considering a career in the financial risk and management domain, pursuing an FRM certification is a wise choice. FRM pass rates typically range ~40–60% depending on part and window; recent published snapshots for Part I have been mid‑40s to mid‑50s. Moreover, GARP does not publish a minimum passing score. Moreover, the importance of risk management is expanding into other areas, including data, operational, and technological risks. This growing significance means that even IT companies and large corporations must develop comprehensive risk reports. So, if you want to stay relevant and skilled in a field that's becoming increasingly critical across all sectors, prepare for FRM to aim for this prestigious designation.

F A Qs :

Q: How long does it take to prepare for FRM Part I and Part II?

A: FRM prep typically spans several months per part; the exact duration depends on prior background, weekly hours, and mock scores—plan buffers to iterate on weak areas.

Q: What are the FRM exam formats and time limits?

A: FRM Part I has 100 MCQs and Part II has 80 MCQs; each is a 4‑hour CBT exam focusing on risk foundations and applied domains, respectively.

Q: What are the topic weights for FRM Part I and Part II?

A: Part I weights: Foundations 20%, Quant 20%, Markets & Products 30%, Valuation & Risk Models 30%; Part II weights: Market Risk 20%, Credit Risk 20%, Operational 20%, Liquidity & Treasury 15%, Risk & Investment 15%, Current Issues 10%.

Q: Do FRM pass rates vary by window?

A: Pass rates vary by window and part; recent snapshots show mid‑40s to mid‑50s for Part I and low‑to‑mid‑50s for Part II; GARP does not reveal an MPS.

Q: Where can candidates find official study materials and learning objectives?

A: Official materials, topic outlines, and learning objectives are available on GARP's FRM study pages.

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj