FRM Jobs in India: Why Most Risk Roles Don't Say 'FRM' and How to Find Them Anyway

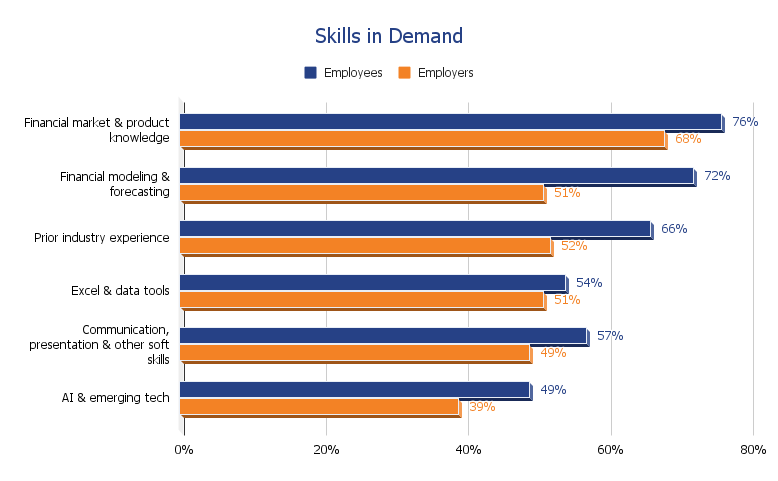

FRM is valuable in India, but it is often "invisible" in job descriptions. Many FRM-aligned roles are written around deliverables and skills, not certifications. Moreover, a recent report by the CFA Institute found that employers prioritize a mix of technical skills like market and product knowledge and financial modelling, plus soft skills like communication and stakeholder management. That same report also notes that 27% of employers value FRM, even though it may not show up as a listed requirement.

Key Takeaways

-

- Employers hire for deliverables: Indian employers hire for skills and deliverables, not certifications; this is why FRM can be "preferred" without being explicitly listed.

- The Bridge Role Strategy: Your fastest path is usually a bridge role (Business Analyst, Risk Ops, Regulatory Reporting) that lets you build risk project experience without "starting as a fresher."

- Keyword Search: Use a keyword-based job search (Basel, stress testing, IRRBB, IFRS 9, ECL, VaR, liquidity, ALM) instead of searching only "FRM jobs."

- Proof Over Titles: Your resume must translate FRM into outcomes: "built risk reports," "validated models," "designed controls," "wrote credit memos," "partnered with stakeholders."

Many roles that strongly overlap with FRM jobs in India (credit risk, market risk, liquidity risk, regulatory reporting, model risk, operational risk). However, they are advertised under broader titles like Business Analyst, Risk Analyst, or Credit Analyst, especially in banks, captive units, fintechs, and large service firms.

FRM Job Market in India (Reality Check)

In India, employers often screen for a balanced profile rather than a single credential, including market and product knowledge (reported as a key skill by many employers), financial modelling, Excel and data tools, and communication skills. This helps explain why FRM can be valued but not explicitly written into many JDs.

The CFA Institute India workforce study also indicates that while CFA and CA show stronger "top credential" signaling, a meaningful share of employers still value FRM (the report notes "value FRM" among hiring preferences). Practically, this means FRM tends to work better in India as a credibility booster plus interview advantage, not as a keyword that automatically unlocks job postings.

Why FRM Is Rarely Written in JDs

1. Many risk jobs are hired as "projects," not "risk roles"

In India, a lot of risk work (reporting, data remediation, model documentation, controls, change management) gets staffed under titles like BA, Consultant, Analyst, or Associate, especially in BFS change programs and service environments.

2. Companies hire for tool + process fit

Job descriptions often emphasize Excel, SQL, dashboards, documentation, stakeholder management, and governance. FRM overlaps strongly with the "what" (risk concepts), but the JD is often written around the "how" (delivery, controls, reporting, tooling).

3. Risk is split across functions

Credit risk, market risk, treasury/ALM, model risk, operational risk, compliance, finance (IFRS), and regulatory reporting can sit in different teams. When ownership is fragmented, the credential signal is weaker than the "domain + delivery" signal.

4. Credential signaling varies by employer type

Global banks' India offices, captive units (GICs), and some fintechs may value FRM knowledge, but large-scale hiring funnels still default to broad titles and generic requirement lists.

Bridge Roles That Work (Even When FRM Isn't Mentioned)

The goal of a bridge role is simple: get paid to accumulate risk-relevant experience while you leverage FRM knowledge for faster ramp-up and better interview performance.

Below is a map of these roles, including a "Day in the Life" view so you know what the work actually looks like.

| Bridge Role Title | Typical Responsibilities | FRM Overlap (What You Use) | Why It's a Strong Entry Point |

|---|---|---|---|

| Business Analyst (BFS / Risk) | Gathering requirements for risk software, mapping data fields (SQL), testing report logic, coordinating UAT. | Risk concepts for requirements, reporting logic. | Gets you into risk programs without needing a "Risk Analyst" title first. |

| Credit Analyst | Spreading financial statements, calculating ratios (DSCR), writing credit notes, monitoring covenants. | Credit risk, default risk, recovery thinking. | Direct pivot path into core credit risk. |

| Risk Analyst (Market / Liquidity) | Running daily VaR reports, checking limit breaches, preparing liquidity gap reports, validating market data feeds. | Market & liquidity risk frameworks, stress testing. | Builds credibility through monitoring outputs. |

| Operational Risk Analyst | Tracking risk events (RCSA), monitoring Key Risk Indicators (KRIs), testing controls, logging incidents. | Operational risk, governance, controls. | High-volume hiring and good for switchers. |

| Regulatory Reporting | Preparing Basel III / RBI returns, calculating RWA, reconciling general ledger data to risk reports. | Regulatory frameworks, risk-weighting logic. | Strong demand when reporting pressure rises. |

| Model Risk Associate | Documenting model logic, performing back-testing, checking data assumptions against policy. | Quant + risk model understanding. | Strong long-term path, stronger with SQL/Python. |

Salary Reality Check: Bridge Roles vs. Core Risk

Many candidates avoid "Business Analyst" roles because they want the "Risk" title immediately. However, bridge roles often pay just as well, and sometimes better, than entry-level risk roles at smaller firms.

-

- Bridge Role (e.g., BA in BFS/Tech): ₹7 - 12 LPA. Often higher in Tech/Captive units due to "Project" budgets.

- Core Risk (Global Bank / GIC): ₹8 - 14 LPA. Highly competitive; requires specific tool skills (Python/SQL).

- Core Risk (Domestic Bank / NBFC): ₹6 - 9 LPA. Good for learning, but starting pay can be lower than Tech/BA roles.

- Ops Risk (Analyst): ₹5 - 9 LPA. Steady growth; easier entry point for non-quants.

Note: Salaries vary significantly by city (Mumbai/Bangalore vs. others) and employer tier.

How to Turn FRM Into Interviews (Even When FRM Isn't Listed)

If you search only for "FRM jobs," you'll miss most of the real market. In India, risk work is often packaged under broader titles, and hiring decisions are made on what you can deliver, not on whether a certification is explicitly named.

1. Use a bridge role if you can't "start over"

If you already have work experience, moving directly into a pure risk title may be difficult without prior risk delivery on your resume. In that case, a bridge role can be the most practical path, especially in BFS environments where you can work on credit, market, liquidity, and regulatory initiatives from day one.

One example discussed in the FRM community is using a Business Analyst role in BFS as a stepping stone into risk and regulatory work when direct entry into a core risk role is not feasible. The objective is simple: get into a role close to risk deliverables, then use that experience to pivot into a dedicated risk designation later.

2. Filter job descriptions by deliverables (not titles)

Instead of asking "Does this JD mention FRM?", ask "Does this JD contain risk deliverables I can do well because of FRM?"

A quick way to screen postings is the 2-of-3 Rule. If a job contains at least two, it's usually FRM-aligned:

-

- Risk domain terms: credit risk, market risk, liquidity/ALM, operational risk, regulatory reporting.

- Deliverables: risk dashboards, limits monitoring, stress testing support, model monitoring, controls testing, regulatory packs, reconciliations.

- Data workflow: SQL extracts, data mapping, UAT, data quality checks, reporting automation.

This is also why keyword-based searching works better than title-based searching: employers write JDs around outputs and processes, not around exam names.

3. Build the skill mix employers screen for in India

In India, employers consistently look for a mix of technical and soft skills. A workforce study commissioned by CFA Institute (with research led by Kantar) highlights that employers value market and product knowledge, prior industry experience, financial modelling, Excel and data tools, and communication and stakeholder management. That same report also notes that a meaningful share of employers "value FRM," but it sits inside a broader hiring preference stack.

So the winning positioning is not "FRM only." It is "FRM + execution layer":

-

- Excel: clean modelling, sensitivities, error checking.

- Data basics: SQL for pulling and validating datasets (even in non-tech roles).

- Communication: summarising risk clearly for stakeholders.

This is exactly why BA and consulting-style roles can work well as entry points: they force you to demonstrate execution and communication while your FRM knowledge strengthens the risk logic behind your work.

4. Run a weekly system that compounds

A job search becomes much easier when it's a repeatable process rather than an occasional burst of applications.

A simple weekly cadence:

-

- Apply to 10 highly relevant roles (only those that match your deliverables filter).

- Message 10 analysts/associates for feedback on your profile and role fit.

- Improve one proof-of-work asset each week (a 1-page credit memo, a small risk dashboard, or a case write-up).

- Do one mock interview drill where you explain a risk concept in business language in under 90 seconds.

This system creates momentum because each week you increase both visibility (applications + outreach) and credibility (proof-of-work), which matters more than the presence or absence of "FRM" in a JD.

Job Search Method (The One That Actually Works)

Keyword clusters for finding FRM-aligned roles

| Domain | Keywords to search |

|---|---|

| Credit risk | IFRS 9, ECL, PD LGD EAD, underwriting, covenant, credit monitoring. |

| Market risk | VaR, stress testing, Greeks, limits monitoring, market risk reporting. |

| Liquidity / treasury | ALM, LCR, NSFR, IRRBB, liquidity gap, FTP. |

| Operational risk | RCSA, KRI, incidents, controls testing, governance. |

| Regulatory / capital | Basel, RWA, capital reporting, regulatory reporting, reconciliation. |

| Data execution | SQL, data mapping, UAT, data quality, dashboards, automation. |

Step 1: Stop searching "FRM jobs"

Search by FRM-adjacent keywords instead.

High-signal keyword clusters to use on LinkedIn/Naukri/Indeed:

-

- Credit: "IFRS 9", "ECL", "PD LGD EAD", "credit underwriting", "covenant"

- Market: "VaR", "stress testing", "market risk", "Greeks", "limits monitoring"

- Liquidity/Treasury: "ALM", "LCR", "NSFR", "IRRBB", "liquidity risk"

- Ops risk: "RCSA", "KRI", "operational risk", "controls testing"

- Regulatory: "Basel", "RWA", "capital reporting", "regulatory reporting"

- Data execution: "SQL", "data mapping", "reconciliation", "data quality", "UAT"

Step 2: Shortlist roles by "deliverables"

If a JD mentions any two of these, it's a strong FRM-adjacent role:

-

- risk reporting packs

- limits monitoring

- stress testing

- model monitoring / validation

- regulatory submissions

- credit memo / underwriting

- controls / governance

Step 3: Build a 2-asset portfolio (even for non-tech roles)

-

- Asset 1: A 1-2 page credit memo (downside case, key risks, covenant proposal).

- Asset 2: A simple risk dashboard (Excel or Python): VaR-style proxy, stress scenario table, or liquidity gap view.

Bring these into interviews. This is how you convert FRM into proof.

What's Coming Next (Trends and the "RBI Angle")

RBI assigned higher risk weights to unsecured consumer loans by 25 percentage points, moving certain exposures from 100% to 125%, and increased risk weights for credit cards as well, which pushes banks and NBFCs to be more cautious and improve risk monitoring and reporting discipline. When capital and risk weights tighten, demand typically rises for people who can support credit monitoring, reporting packs, data checks, and model documentation.

Even when FRM isn't named, the market is pulling toward FRM-like work, and much of it is driven by regulatory pressure.

-

- RBI Scrutiny on Unsecured Lending: Recent risk-weight increases mean banks and NBFCs need sharper credit models and better reporting. This creates demand for Credit Risk Analysts and Data Analysts who understand capital requirements.

- Operational Resilience: The push for better IT governance and fraud controls is expanding the "Operational Risk" market beyond just tick-box compliance.

- More Governance and Reporting: As regulations tighten, banks need more people to handle "controls culture" and documentation.

- Growth in Private Markets: Private credit growth increases the need for fundamental credit analysis and downside frameworks.

- AI and Model Risk: More monitoring, validation, documentation, and audit readiness is required, especially in global banks.

These trends reward candidates who combine FRM concepts with delivery ability, documentation habits, and basic data skills.

Is FRM Still Worth It in India?

FRM is worth it in India when you treat it as structured learning plus an interview advantage, then pair it with evidence of execution skills and deliverables employers screen for. It is less effective if you expect the credential name alone to unlock postings, because many JDs focus on tools, reporting, and delivery rather than listing certifications.

FRM is worth it if you treat it as:

-

- a structured way to learn risk across domains, and

- a credibility and interview advantage, and

- a supplement to a role strategy that builds experience.

It is not worth it if you expect "FRM" to be the keyword that unlocks a large number of postings automatically.

If you already have experience in BFS, finance, audit, operations, or analytics, FRM can accelerate you into more risk-heavy work, especially through bridge roles.

Conclusion

FRM in India is often missing from job descriptions because hiring is driven by deliverables, tools, and domain experience, even though a meaningful share of employers still value FRM. The winning strategy is to target FRM-aligned bridge roles, search by risk keywords, and translate FRM topics into proof through a memo, dashboard, reporting sample, or model monitoring note that matches the job's outputs.

If you want structured guidance to build those foundations faster, use Aswini Bajaj Classes to strengthen your risk concepts and then convert them into resume-ready deliverables through consistent practice and mock interview drills.

FAQs

Q: Is FRM in demand in India?

A: Demand shows up more through risk and regulatory job families than through "FRM required" postings, and 27% of employers report that they value FRM.

Q: Why don't job descriptions mention FRM if the work is risk-related?

A: Many JDs are written around delivery requirements like reporting, controls, data mapping, and stakeholder coordination, so certifications get listed less often than tool and execution skills.

Q: What is a good entry role if I have FRM knowledge but no risk experience?

A: Bridge roles such as Business Analyst on BFS risk programs, credit analyst, operational risk analyst, or regulatory reporting can get you paid risk exposure while you build outcomes.

Q: What two skills make FRM more employable in India?

A: Excel plus data skills like SQL matter because employers often screen for Excel and data tools alongside financial modelling and communication skills.

Q: What should I show in interviews if FRM is not listed?

A: Show proof of work that matches deliverables, such as a one-page credit memo, a simple risk dashboard, or a short model monitoring note.

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj