CFA 2026 Curriculum Changes: What Candidates Need to Know

Chartered Financial Analyst (CFA) is a globally recognised designation in the field of finance. Highly recommended for those who wish to build a career in Investment Banking, Equity Research, Portfolio management, Consulting, and beyond. Knowing the curriculum is essential to prepare better. Staying updated on important changes to the CFA 2026 curriculum and fee structure will be helpful for candidates to keep their preparation on track, make the most informed decisions, reduce surprises, and plan the study approach more effectively.

The CFA Institute updates its curriculum almost annually to reflect industry changes. The CFA 2026 Curriculum Changes are subtle but important for candidates. This blog will cover key curriculum changes, updated fees, and provide tips to help candidates plan effectively.

CFA Curriculum Changes: What to Expect in 2026

The CFA 2026 curriculum retains its core structure; however, to align with industry needs, a few updates and clarifications have been made.

Level I: No Changes

For Level I candidates, there are absolutely no changes in the CFA 2026 curriculum, which allows candidates to use the 2025 books and no need to purchase the new books. Check the CFA syllabus for a detailed understanding of what the curriculum covers.

Level II: A Minor Change

For Level II candidates, there is a small update in the 2026 curriculum. LOS E has been removed from the chapter - Machine Learning, subject - Quantitative Methods. If you've already studied, you've learned a bit extra. 2025 books are absolutely fine to continue, only this LOS is not needed. For a detailed understanding, check the CFA syllabus changes as well.

Level III: Specialized Pathways Continue

Just like Level I, for Level III candidates also there are also no changes in the 2026 curriculum. The major changes in the 2025 curriculum remain the same in 2026, which include the introduction of the three Specialized Pathways - Portfolio Management, Private Wealth, and Private Market.

Take the quiz to choose the right pathway. These pathways provide deeper insights into niche areas of investment management. If you're planning to sit for Level III in 2026, make sure you're familiar with the specific requirements of your chosen pathway, as this will guide your study focus.

Key Takeaways for 2026 Candidates:

-

- Level I: No changes, focus on the foundational areas.

- Level II: Machine learning topics removed, giving more focus to traditional Quantitative Methods.

- Level III: Specialization pathways (Portfolio, Private Wealth, Private Markets) continue unchanged.

💡 Pro Tip

The CFA 2026 syllabus changes might seem minor, but they reflect an important shift toward focusing on industry-relevant skills. Make sure to adapt your study strategy accordingly, particularly if you're in Level III.

For more details on how these changes might affect your exam preparation, visit Aswini Bajaj Classes' CFA course page.

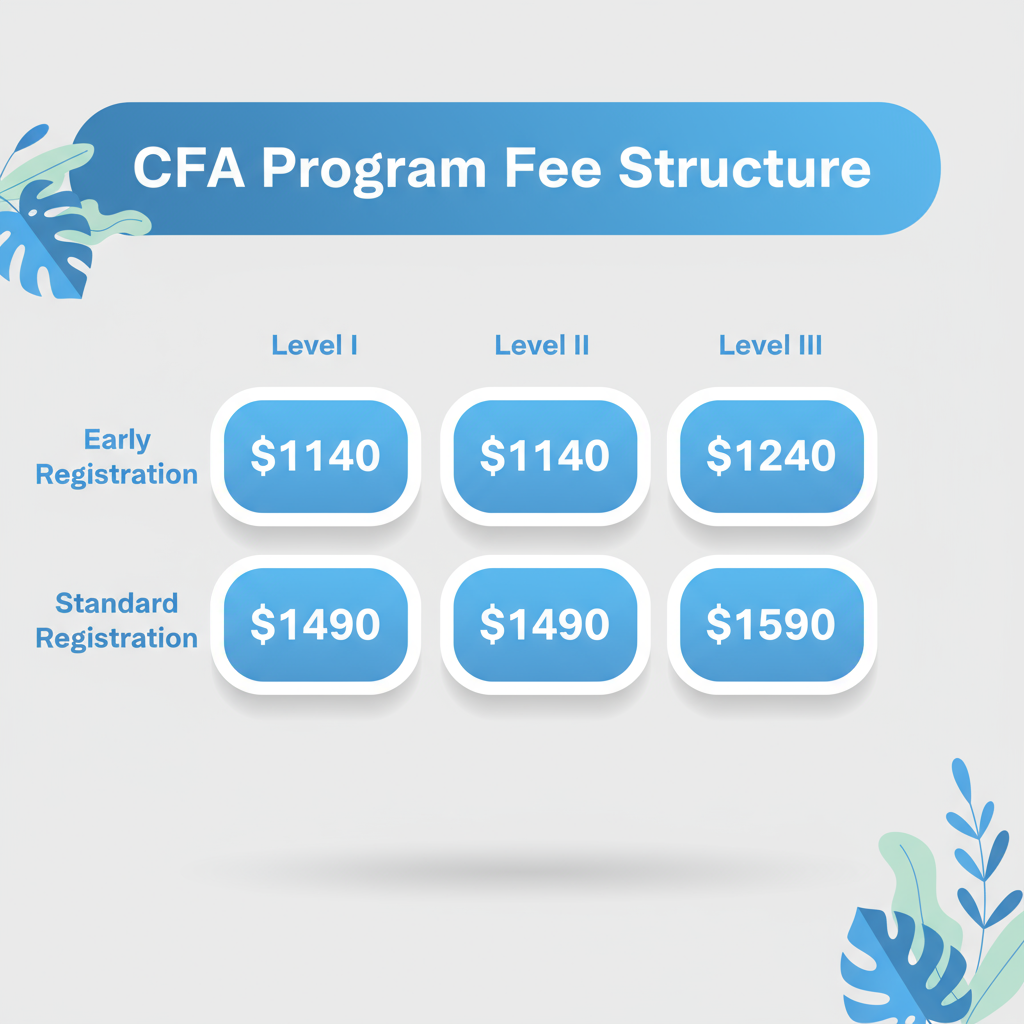

CFA Fee Structure and Registration for 2026

In 2026, the CFA exam fees will see some important changes. Here's what you need to know:

Fee Structure Breakdown:

-

- Level I Early Registration: $1140

- Level I Standard Registration: $1490

- Level II Early Registration: $1140

- Level II Standard Registration: $1490

- Level III Early Registration: $1240

- Level III Standard Registration: $1590

Additional Fees:

-

- Rescheduling Fee: $250

Key Change for 2026: The $350 enrollment fee has been removed starting from 2026. This change will make the exam slightly more affordable, especially for first-time candidates.

By registering early, you can save on fees. The early registration period offers significant cost savings, so it's wise to plan ahead and commit to your exam as soon as possible.

How much will the CFA cost in 2026?

With the removal of the enrollment fee, Level I and Level II early registration costs will be $1140, while Level III costs $1240 for early registration. However, opting for standard registration will increase costs to $1490 and $1590 for Levels I, II, and III, respectively.

Be sure to check the CFA registration page at Aswini Bajaj Classes to track important dates and deadlines.

Preparation Tips for CFA 2026 Candidates

As the CFA 2026 syllabus changes are relatively small, much of your preparation for Levels I and II can follow traditional study plans. However, candidates planning for Level III will need to focus on the specialized pathways offered. Here's how you can approach your study plan:

CFA Level I: Focus on Core Topics

-

- Stick to the core curriculum and give yourself plenty of time to cover each topic.

- Use question banks to reinforce the fundamental concepts.

- Stick to a study schedule that gives ample time for revision.

CFA Level II: Understand the Quantitative Methods Shift

-

- Since machine learning has been removed from Level II, shift your focus back to traditional methods like regression analysis and time-series forecasting.

- Build your understanding through practice questions, especially around complex calculations and model building.

CFA Level III: Dive Into Specialized Pathways

-

- Take time to understand the unique requirements of your selected pathway.

- For Portfolio Management, focus on asset allocation strategies and risk management.

- For Private Wealth, focus on client-centric portfolio strategies, tax, and estate planning.

- For Private Markets, emphasize private equity, venture capital, and hedge fund strategies.

💡 Pro Tip

Plan your study sessions using Aswini Bajaj Classes' study calendars and coaching programs for structured guidance. Don't forget to stay on top of important exam deadlines with the CFA exam calendar!

Conclusion

The CFA 2026 curriculum changes may seem relatively minor, but they mark an important shift in how the CFA Institute is tailoring the program to meet evolving industry needs. With a slight adjustment to Level II and the introduction of specialized pathways for Level III, candidates need to adapt their preparation accordingly.

As always, early registration is crucial for both cost savings and securing your spot. Take time to understand the changes and plan your study schedule effectively to stay ahead. Remember, the earlier you start, the better your chances of passing with flying colors.

Explore CFA courses and helpful toolkits at Aswini Bajaj Classes to streamline your exam preparation today!

F A Qs :

Q: What changed in the CFA 2026 curriculum?

A: Level I remains unchanged from 2025; Level II removes a Machine Learning learning outcome in Quantitative Methods; Level III specialized pathways (Portfolio Management, Private Wealth, Private Markets) continue without change.

Q: How much will the CFA cost in 2026?

A: The CFA 2026 registration fees vary by level:

• Level I and II Early Registration: $1140

• Level III Early Registration: $1240

• Standard registration costs increase to $1490 and $1590.

Q: What are the CFA 2026 curriculum changes?

A: The CFA 2026 curriculum sees no changes in Level I, a minor Quantitative Methods change in Level II, and continued specialized pathways for Level III.

Quick Navigation

Latest Post

Preparing For CFA Exam Day

It is very natural for students to think that they have prepared enough. While recognizing that sufficient preparation has been accomplished, you may want to take a few mock tests.

17-12-2024

Understanding CFA Scholarships

Pursuing the CFA charter can significantly elevate your career, but the associated costs can be challenging.

10-09-2024

The best way to prepare for FRM

The financial world thrives on calculated risks. But without proper management, those risks can morph into crippling losses.

16-11-2024

Classes

Merchandise

© 2026 All Rights Reserved @Aswini Bajaj